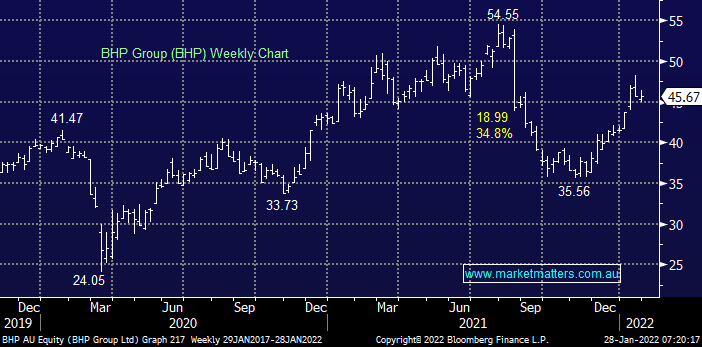

We are reducing our 9% holding in BHP Group (BHP) to re-allocate capital elsewhere. This will leave a 6% weighting.

MM are reducing BHP in the Flagship Growth Portfolio, taking profit around $47.00

Add To Hit List

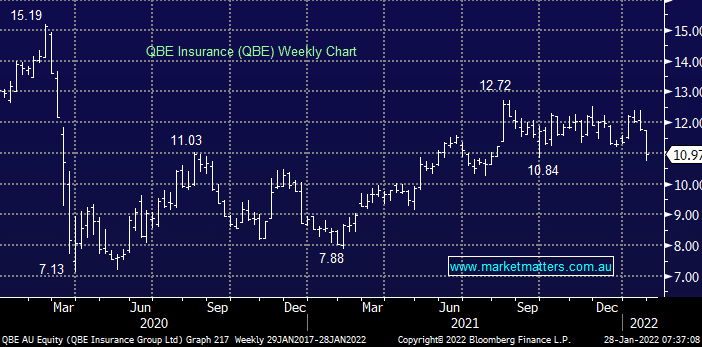

We are selling our 4% holding in QBE Insurance (QBE) to use funds elsewhere.

MM are selling QBE in the Flagship Growth Portfolio, taking a loss around $11.00

Add To Hit List

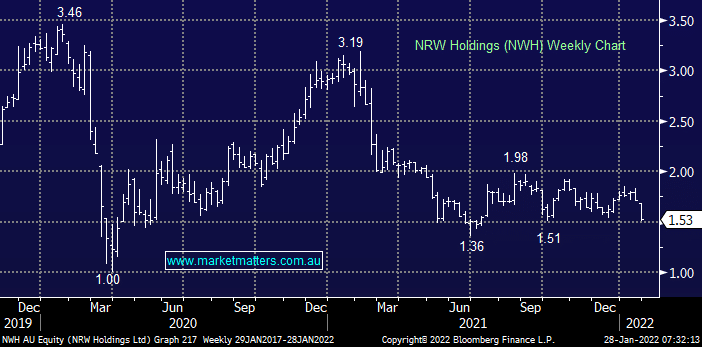

We are selling our 5% holding in NRW Holdings (NWH) to use funds elsewhere.

MM are selling NWH in the Flagship Growth Portfolio, taking a loss around $1.55

Add To Hit List

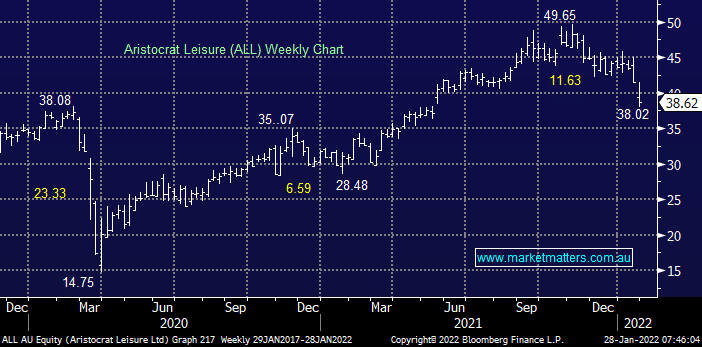

We are buying Aristocrat (ALL) into recent weakness.

MM are buying ALL in the Flagship Growth Portfolio, allocating 5% around $39.00

Add To Hit List

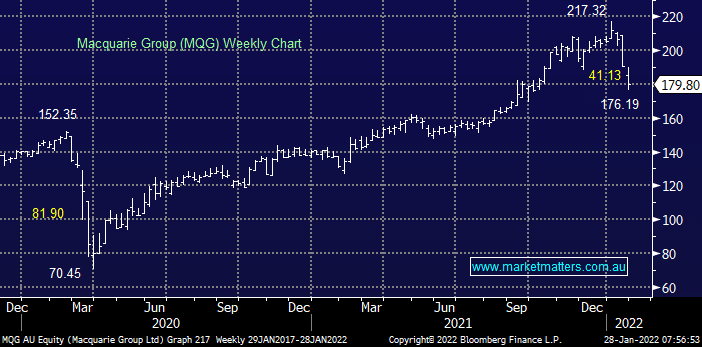

We are buying Macquarie Group (MQG) into recent weakness.

MM are buying MQG in the Flagship Growth Portfolio, allocating 5% around $180.00

Add To Hit List

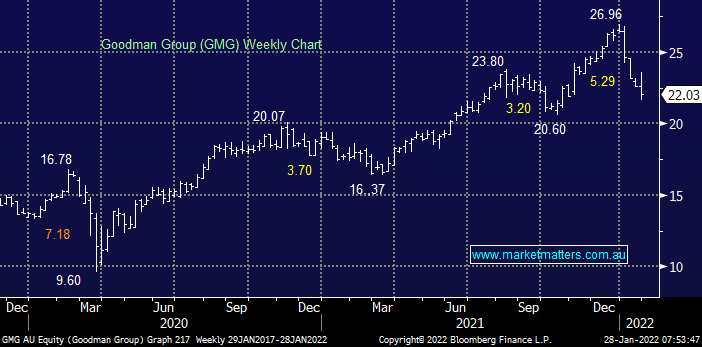

We are adding to our existing position in Goodman Group (GMG), taking the position to a 6% portfolio weighting.

MM are adding to GMG in the Flagship Growth Portfolio, allocating a further 2% around $22.20

Add To Hit List