BHP, CIA,& RIO – Iron Ore

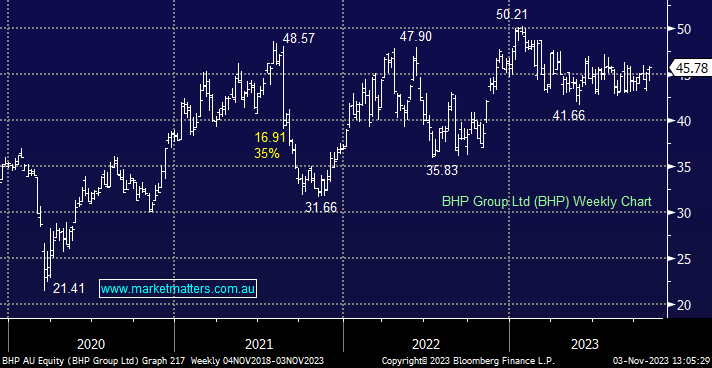

Dear James, am interested to hear your views on Champion Iron as a leveraged play to the buzz on iron ore? Secondly - MM has put its weight in the Growth fund behind BHP, longer term I can see the point of this, however it is going through a lot of change - why is MM so bullish BHP rather than RIO, which has been through a lot of negativity in the past few years which it now seems to be coming out of positively - perhaps it has better upside in the shorter term? After all MM doesn't just own one bank...