Hi Boon,

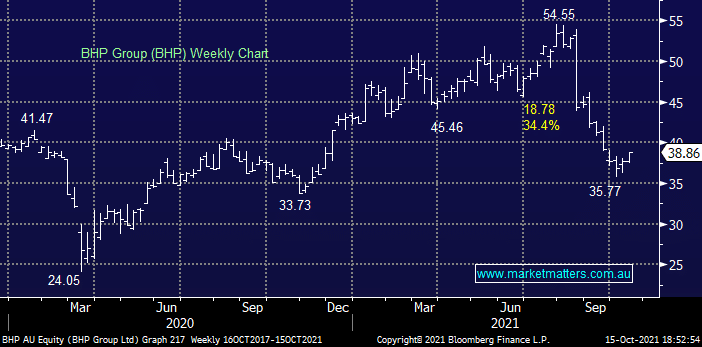

There are a few variables in here starting with the $20bn scrip deal only being a potential scenario although we do believe it will ultimately proceed in 2022. Overall it appears to us that both stocks have been unfairly treated as the deal appears attractive but in the case of BHP Group (BHP) there’s been the case of a plunging iron ore price to factor into the equation i.e. moving forward the bulk commodity is still likely to represent at least 50% of its revenue for years to come.

- BHP is looking to offload its petroleum business to WPL, or someone else, for around $20bn as it evolves into a “greener” business.

- Considering crude oil is trading at its highest level since late 2014 the timing feels ok for BHP, especially when combined with fund managers ongoing dislike for fossil fuel.

- Our expectation is the BHP share price will simply drop by the same degree of the distribution to shareholders, the markets very efficient in these circumstances – remember shareholders are likely to get WPL shares, not cash although they can simply sell the WPL shares if they wish. BHP shareholders will own around 48% of the expanded Woodside via the issue of new shares in WPL.

The short of it is MM likes the BHP / WPL deal for both companies and believes it will go ahead in 2022.