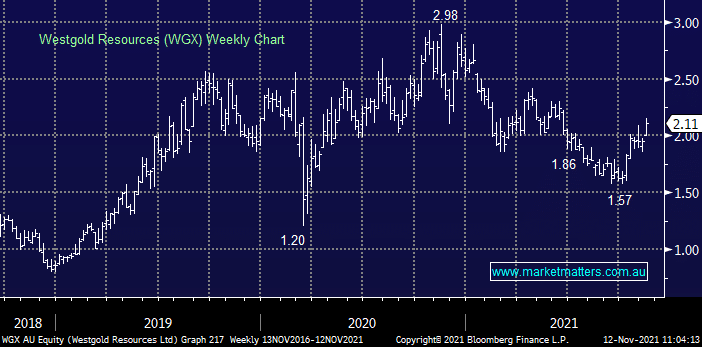

The energy sector + Westgold (WGX)

James, Enjoying the content & updates. Your insight to the following please . . . Held WPL for over 12 months. Does not seem have tracked Exxon or Chevron with the rise in oil price & LNG, now becoming frustrated with it treading water. Based upon current expected cash flows, why is the stock lagging? Is it to do with ESG concerns, the BHP merger or other factors? Continue to hold or would you suggest to build a position in BHP with WPL funds? BHP - a buy at these levels? If they merge with WPL what do you envisage happening with the share price? Will it drop in relative the number of WPL shares received? WGX - Following an unsuccessful takeover of Gascoyne (due to the Firefly Scheme agreement), would you envisage they will have another go when GGC & FFR merge. They seemed to be in 'box seat' with GGC shareholders. Would this be favorable for WGX?