Is BHP a buy in the current economic climate?

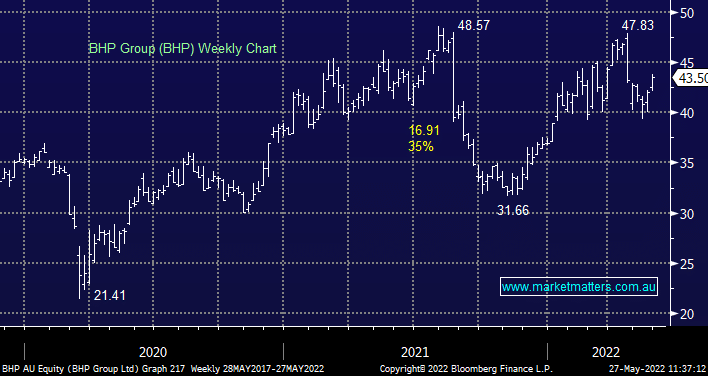

Hi James and Team, Is BHP a buy in the current economic climate? In April (approx. the 4th) MM quoted a piece written by UBS that explored periods of high inflation coupled with slowing growth. UBS then dug a little deeper into "sector changes in returns "and I quote MM "UBS found Energy & Materials (watch out Woodside and BHP!), ... see a sharp deterioration in returns". The piece then goes on to mention "stagflation" and how even defensives will lose ground. Today market commentators see stagflation as a risk. Today MM still views BHP as a BUY below $50. Sorry to put you on the spot but could you please elaborate on why MM are more upbeat today than early April. Thanks,