Hi Sam,

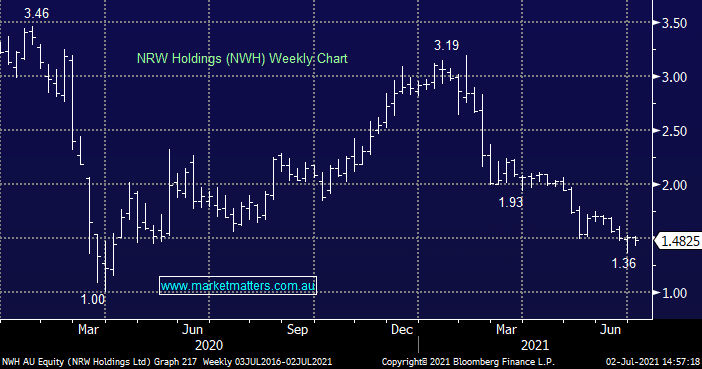

The issue with large paper losses is they usually come as a result of a company downgrade which often results in the stock “gapping down 10-20%”, or even worse in some cases – see NRW Holdings (NWH) below. At MM we exit a position when the reason that we hold the stock has gone, especially from a risk / reward perspective, & / or the stock no longer represents the value it once did. That’s not about being a ‘value’ investor, but an investor targeting value in many forms. Stop losses should be used in mechanical trading systems that reply totally on price. Whether that be momentum systems, regression or one of the many technical trading strategies out there. Put simply, I believe stops at say 5% or 10% have no logic as its purely a predetermined monetary decision as opposed to taking into account the situation today i.e. markets are like a constantly evolving amoeba and should be evaluated as such.

However if you do want to quantify your downside, which can be good for sleep, there are a number trading platforms that take such orders.

NB Also with regard to pre-set stops there are no guarantees of price, a stock may be trading at $10 and you have a stop at $9 but after some bad news the next trade is at $8, you will be filled around $8 not your stop at $9