Hi Ram,

Important to remember that MM provides general as opposed to personal advice. The weightings of your portfolio are a decision for you.

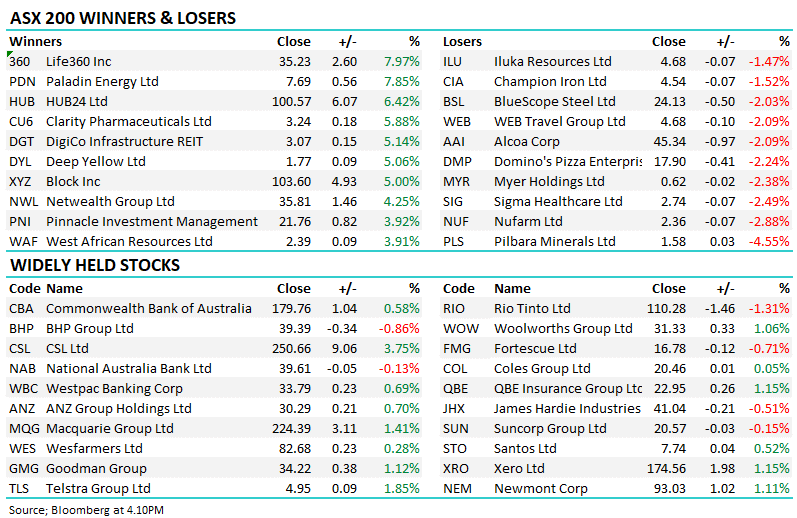

At MM we remain bullish on resources generally based on our reflationary expectations, although we wouldn’t be surprised to see some reversion of this view in the short term term (i.e) resources to cool short term and tech to partially recover. We hold BHP and RIO in MM portfolio’s, and would be a keen buyer of FMG 5% lower.

Our preference in order is: 1. BHP 2. RIO 3. FMG

In terms of other sectors, we like companies exposed in infrastructure development like Lend Lease (LLC) and we like specific value opportunities like Crown (CWN). Ideas can be sources from our portfolio’s here.