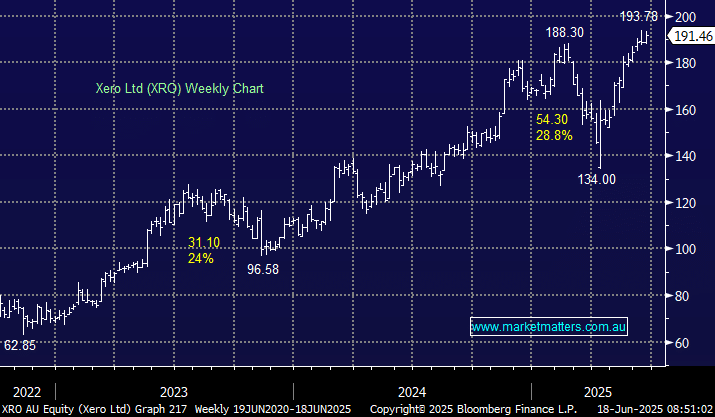

The online accounting platform Xero (XRO) has been a core holding for several years. While the future for XRO is bright, we believe the risk/reward into new highs is unappealing. We have little doubt that we’ll be owners of XRO again, but for now, we’re locking in a ~90% profit.

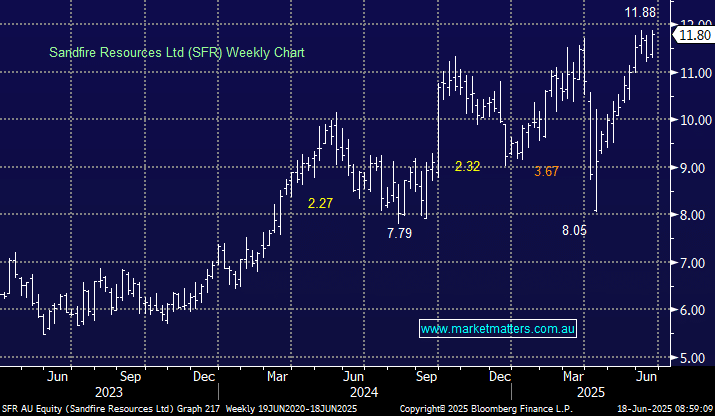

We bought Sandfire (SFR) in April and the stock has now rallied ~40% since. While we like the copper thematic, and SFR is executing very well operationally, inline with our comments this morning, we are reducing from a 4% target (which is more like 6% in real terms), back to a 3% target weight. Trimming positions and managing weightings is an important aspect of portfolio management.

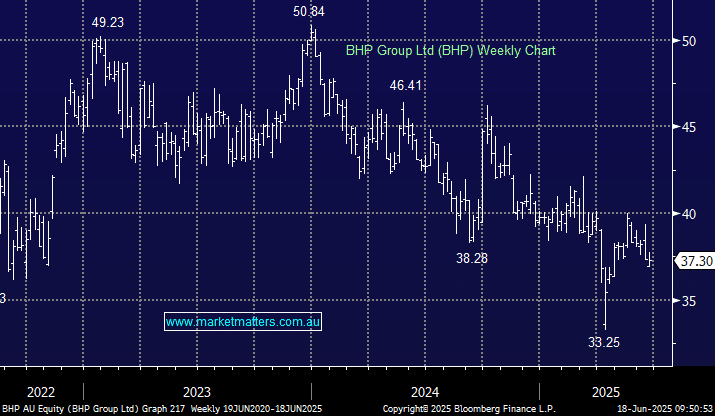

Recent weakness in BHP presents an opportunity to mildly increase our holding, up from a 7.5% target to an 8.5% target weight.