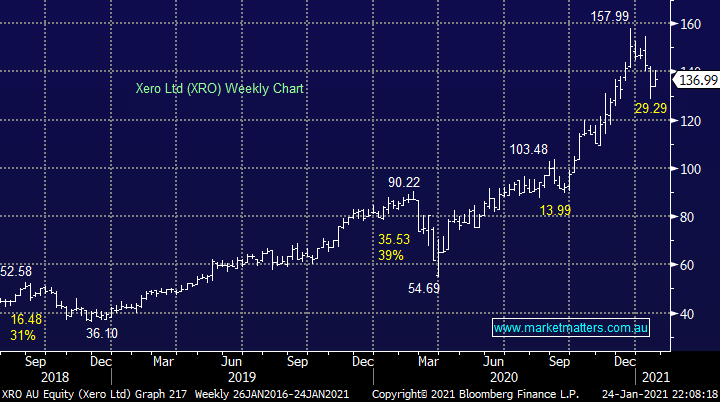

MM thoughts on XRO

“Hi Guys, I have recently cashed out Xero shares because their current share price and business model is unsustainable. They are hardly turning a profit let alone paying dividends to shareholders. I know that they have their reasons and are pushing for further growth but what is the delay? Why aren't small businesses using online software? How much further growth can they realistically expect? It appears that great hype comes with great expectation but the jury is still out on Xero. My investment philosophy has always been that the most valuable assets are income producing assets. We live in unprecedented times.” - Regards, Cade Z.