MM’s views on ASX sectors and specific companies please

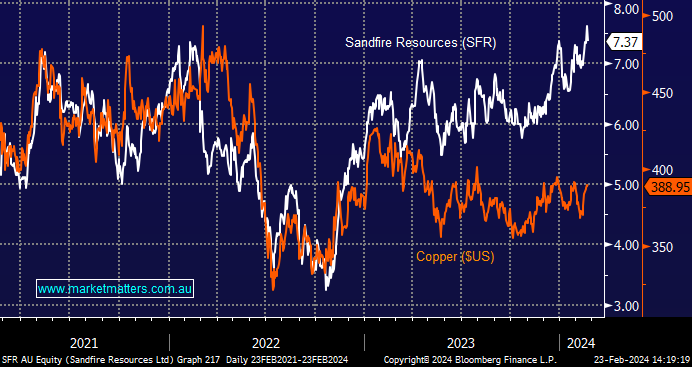

Hi James and team, Thank you for the informative reports which I look forward to reading everyday, especially the forward looking portfolio positioning segment. I would appreciate your views on sector strengths and weaknesses for the ASX over the course of 2024 (eg. resources/tech/domestic retailing), gold miners v. physical gold, and specific companies in CAR, REA, JBH, AX1. Also, do you have a view on the reason for the strength of SFR versus the general copper sector and FCX? I've been looking to add and hope there will be an opportunity over the course of the year. Thank you again for keeping us on track. Adel