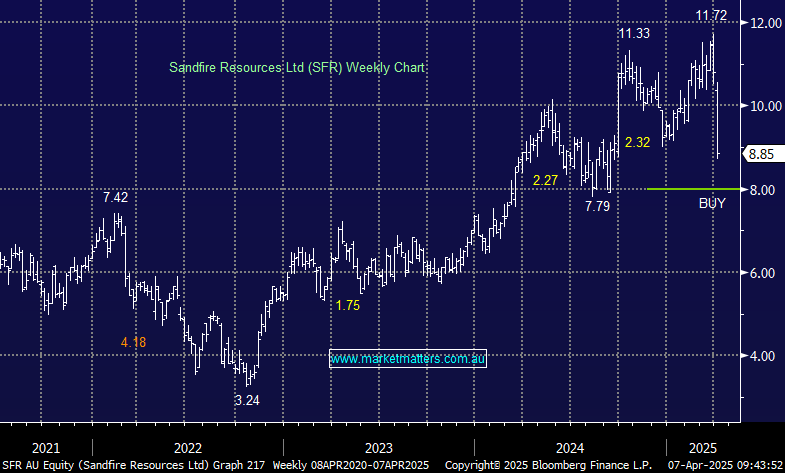

We are trimming our position in BHP by ~2%, taking it to a 7.5% target weighting, to partially fund a new position in Sandfire Resources (SFR) which we are buying into extreme weakness this morning. We have a preference for Copper in the medium term and now have an opportunity to mildly increase that exposure.

We are buying back into Sandfire Resources (SFR) into extreme weakness, partially funding by a reduction in BHP. This is a mild increase in Copper exposure, and a mild increase in risk into weakness.