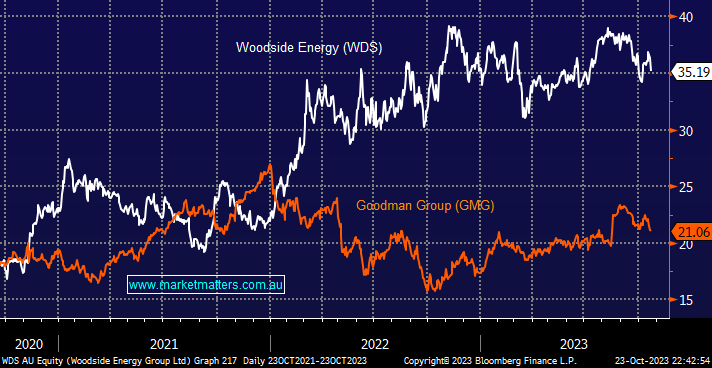

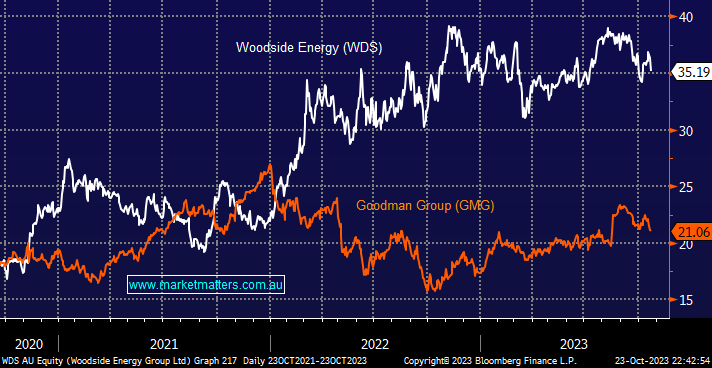

The Energy Sector and oil prices have both failed to post recent highs even as the Israel-Hamas conflict continues to dominate the news, not a fresh concern for MM, but one that has been percolating for a few weeks. The reason for our position in WDS has largely gone, and with no dividend in the coming months, we question why MM is still holding the stock. We are showing a +3.7% paper profit in WDS before this morning’s opening.

Conversely, we like Goodman Group (GMG) following their solid result in August, where they delivered a 16% increase in earnings per share (EPS). We discussed the stock in a recent Portfolio Positioning Report, adding it to our Hitlist in the process, we especially like their future direction into data centres. If/when we purchase GMG, it will join Altium (ALU) and Mineral Resources (MIN), which we have bought into market weakness following solid results in recent months.

- We believe the post-GFC advance by oil and its respective stocks is maturing fast and may have already peaked while GMG and the Real Estate Sector are set to address its underperformance.