Your comments on some stocks please

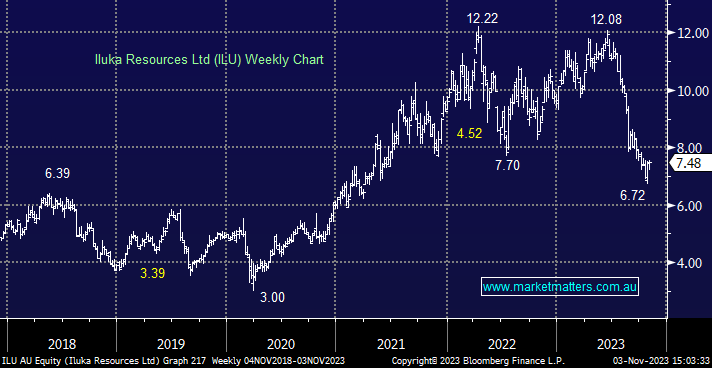

Hi James, I have been out of the country for a month and have sort of lost touch. There are 5 stocks I would like to ask you about. These are: WDS, AWC, PPT, ILU, LYC. WDS - This stock seems to be going backwards, but, the price of oil is going upwards. This seems to be a contradiction to me. AWC - This stock has fallen a great deal. Is it possible that it might be a good buy now or is Aluminum going to be in the toilet for a long time yet again? PPT - I have invested a lot in this stock and it keeps going down. Should I be worried? The analyst forecasts are mostly positive. This is also a contradiction. ILU - This seems like it might be a good long term buy. It pays a reasonable dividend and it might really take off in a few years.LYC - Is it possible that this stock's day is FINALLY coming? Thank you, Paul