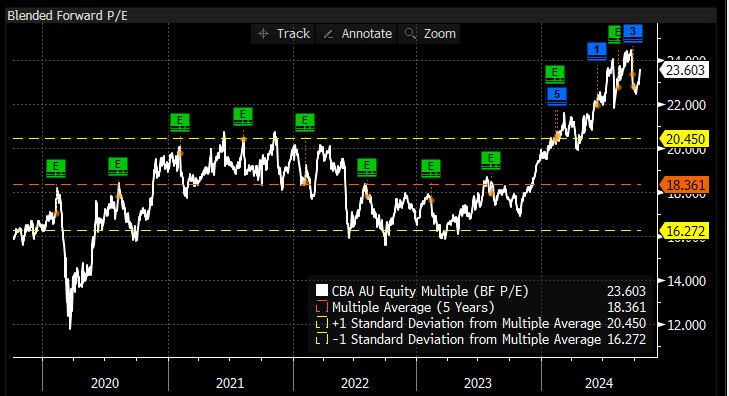

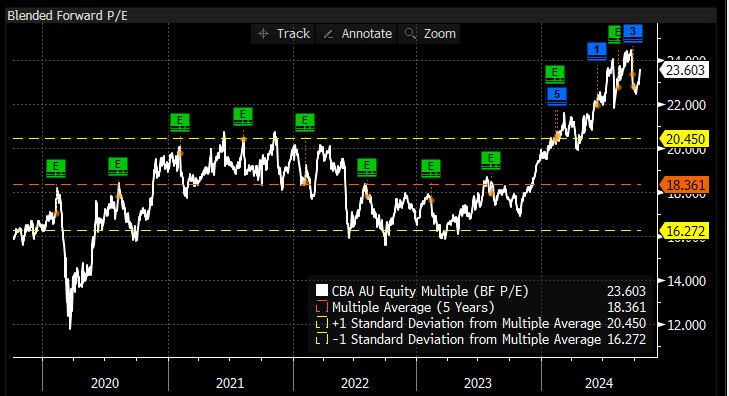

As mentioned earlier, analysts are negative on CBA on valuation grounds. Nobody is questioning its quality, but around $140, it does look rich.

- CBA is trading ~30% above its average valuation over the last five years and on over 3x book value – it’s expensive on all metrics.

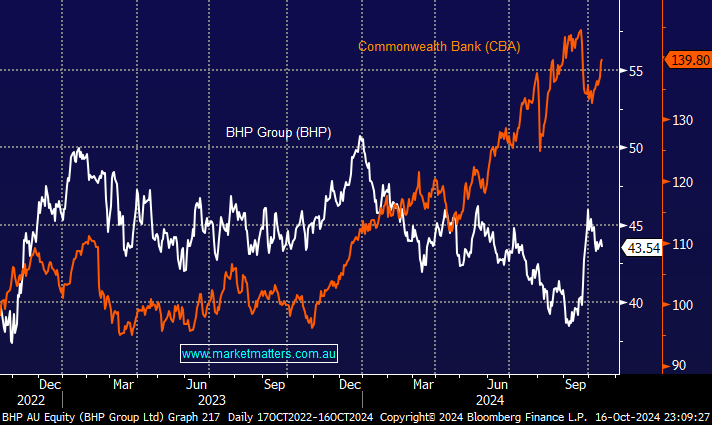

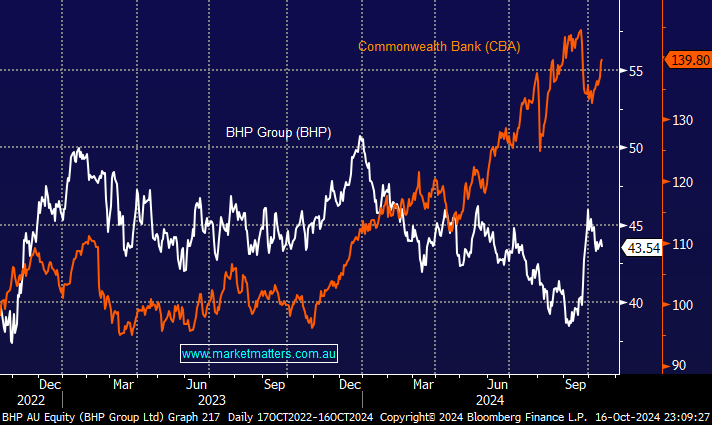

We saw CBA drop aggressively in late September when investors switched into the resources; we believe this is a warning of what will follow in 2025 with the million-dollar question from where, a couple of “calls”:

- Following strong results by US banks, we can see CBA making fresh highs into Christmas, but we wouldn’t be chasing this strength.

- Assuming the ASX resource stocks consolidate further over the coming weeks, in line with Chinese stocks, the extreme valuation gap between BHP and CBA could extend further.

The gap between BHP and CBA contracted when China fired its first stimulus salvos, but it looks likely to stretch further in the coming weeks—remember, trends have a tendency to stretch further than most people imagine possible. We believe BHP(resources) will outperform CBA (banks) through 2025, and portfolios should be constructed accordingly. While banks look well positioned for one more squeeze higher, this is a move we would fade.

- We believe the price differential between BHP and CBA is approaching a peak, but it might have one final squeeze.