Hi Richard,

There are two main reasons why Hybrid prices have tracked lower:

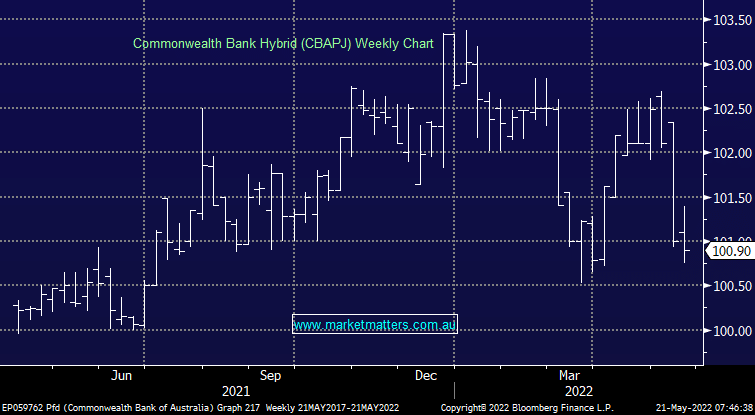

1. Credit spreads have widened which is a measure of risk. The market is pricing in a higher chance of a recession than it did a few months ago.

2. The hybrids pay a margin over the bank bill rate. As you rightly point out, bond yields have risen making fixed rate bonds themselves more palatable which is a theme we have discussed in recent notes and why our last fixed income purchase in the Income Portfolio was a bond. Hybrids pay a margin over BBSW. If that margin is say 3% and the BBSW is only 0.3%, the rate a hybrid will pay is more than 10x what an investor can get on their money in the bank. However, as rates rise investors can suddenly get 2.75% in a 1 year term deposit which is what Macquarie is offering. While the yield on the hybrid has also gone up and now sits at ~6% (BBSW + margin) that’s only a bit over twice the rate of a no risk TD and is therefore relatively less attractive. i.e. investors can now take lower risks to get a satisfactory return.

The new restrictions you mentioned only impact new issues, whereby brokers that are on the deal can only offer hybrids to sophisticated investors or retail investors that are receiving personal advice (which carries a bunch of regularly requirements such as fact finds, statements of advice etc). I doubt these changes are having a big bearing on the secondary market.

We are still holding hybrids, I’m still buying Hybrids for clients as part of a diversified fixed income exposure, but it now includes some bonds when that wasn’t the case 6-12 months ago.