Your view on banks and APA

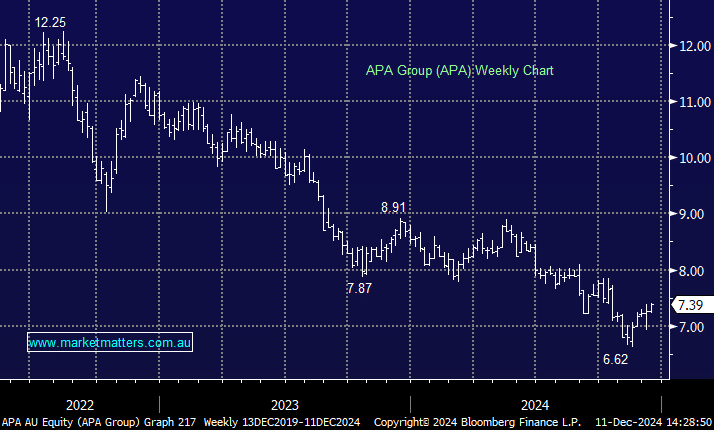

Hi Team , Many pundits are saying to sell CBA as they think it MUST correct down____and they may well (eventually) be correct. What of the OTHER 3 of the Big Four? They are all trading at prices that they have not seen in a decade, maybe 2 decades in some cases. The banks have been dividend traps for many years. The dividends are attractive but there is almost no growth except for CBA. To me it is probable that the lesser 3's present high prices won't last. What do you think? Now that APA has received a ruling regarding regulation it would seem that it should ( FINALLY ) rise a bit . Your thoughts? The Team at MM MUST be head & shoulders above anyone else giving generic advice. Keep on keeping on !! You ARE APPRECIATED. PC