What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

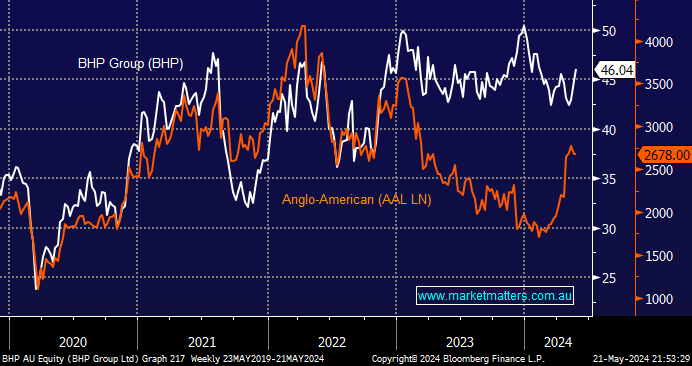

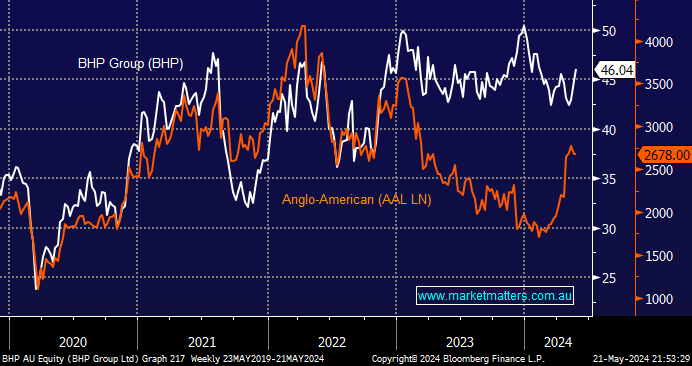

The potential ~$64bn takeover of Anglo-American (AAL LN) by BHP has dominated the news in recent weeks, but the clock is ticking, at 5pm London time tonight, the door will close, for now at least. It will come as no great surprise if BHP walks as Anglo’s CEO Duncan Wanblad and the rest of the AAL board appeared to have no interest in discussing a bid – at least at the current price point BHP’s offer was implying. However, there is still a chance that BHP could lob in a “best a final” conservative bid aimed at disgruntled shareholders before the window closes, making BHP a tricky proposition at current levels.

- This morning, BHP is set to open at a three-month high on a growing view that it will not make a third tilt at AAL, combined with a supportive backdrop for the commodities market.

A number of members have asked the question, what’s next? The answer is largely dictated by BHP’s $243bn huge market cap. i.e. there is no point in BHP spending the time and effort purchasing a company that won’t have a meaningful impact on its profitability, even if it’s all copper:

- Anglo-American is a +$60bn business that receives 32% of its EBITDA from copper, which is certainly meaningful for the “Big Australian.”

- Conversely, Sandfire (SFR) and Evolution Mining (EVN) are ~$4.6bn and ~$8bn businesses; even combined, they’re not in the same league as AAL.

- Last year, BHP paid $9.6bn for OZ Minerals (OZL) when copper was 25% cheaper; it would cost a lot more today.

According to an analysis from S&P Global Market Intelligence, the demand for copper, a key component of electrical wiring, solar panels, wind turbines, and electric vehicles, is expected to double by 2035. Even with all the indicators pointing to higher copper prices and BHP having shown its hand towards the industrial metal, we cannot see them considering either SFR or EVN;

- We’re sure BHP is continually running its slide rule across global assets that have a strategic fit and come with the synergic value-add, but our guess is they will go quiet for a while after coppers surge higher over recent weeks.

- We continue to like both BHP in line with our bullish outlook towards the Resources Sector.

The ASX200 edged down 0.15% on Tuesday as the Materials and Healthcare Sectors weighed slightly on the index, but overall, it was a fairly quiet affair. The market’s hovering less than 2% below the psychological 8000 level, and we believe it’s just a matter of time before it enjoys an eight handle, but gains are likely to remain very stock and sector-specific, as they’ve done so throughout this year:

- Year to date, the Tech Sector has led the pack, surging +24.3%, with the Utilities playing a supporting role up 11%; conversely, The Consumer Services & Staples Sectors have struggled, along with the Materials stocks, which are down 3.5% – the latter might surprise some.

However, as we often say at MM, “there are lies, damned lies and statistics”, and if we change the timeframe, the picture changes dramatically, i.e. quarter-to-date, the Materials Sector is up +4.8%, compared to Tech, which is basically unchanged. We believe this performance reversion has further to go as investors look for value in a market that’s knocking on the door of all-time highs.

- This morning, the SPI Futures are pointing to a higher open, up around 0.3%, aided by a 20c gain by BHP in the US ahead of its AAL deadline.