We are trimming our position in Audinate (AD8) following a strong rally to new all time highs. The stock is expensive and may see some USD headwinds. We maintain a 3% position given it’s market dominance, and will upweight again if better risk/reward levels present themselves.

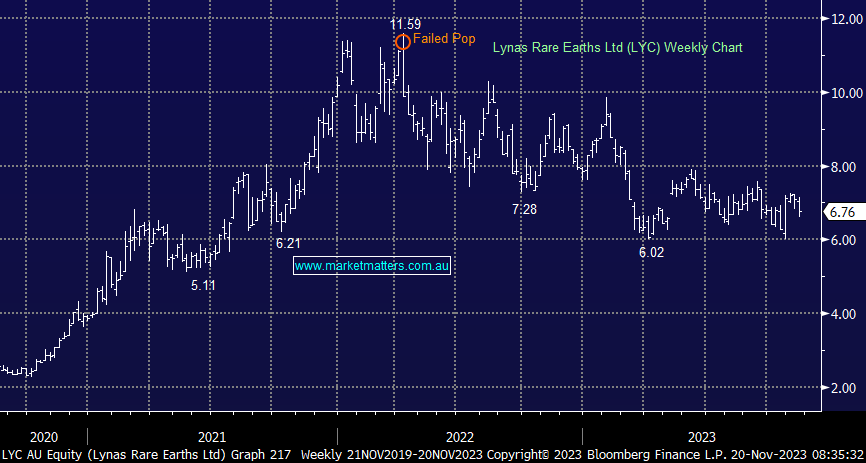

While we like the Rare Earths market over the medium term, LYC has failed to rally significantly on positive news flow, and we expect the position to ‘tread water’ at best into 1H CY24.

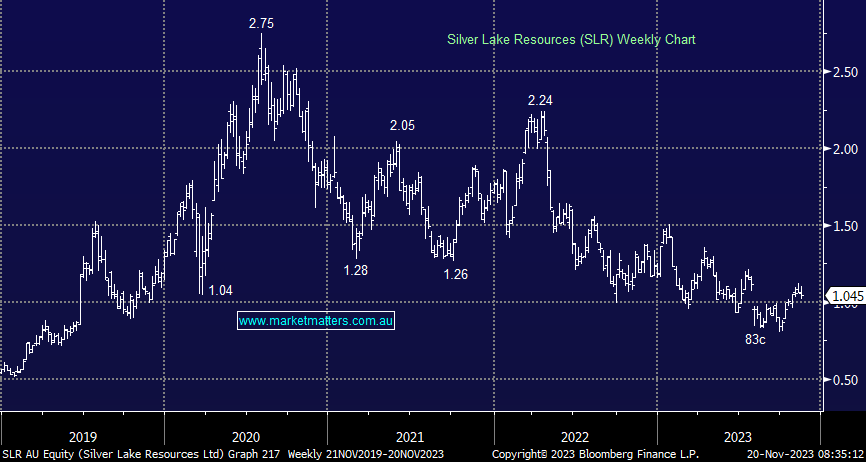

We are adding to our gold exposure, continuing to see support for precious metals into 2024 with Silver Lake (SLR) our preferred pick of small/mid-cap stocks.

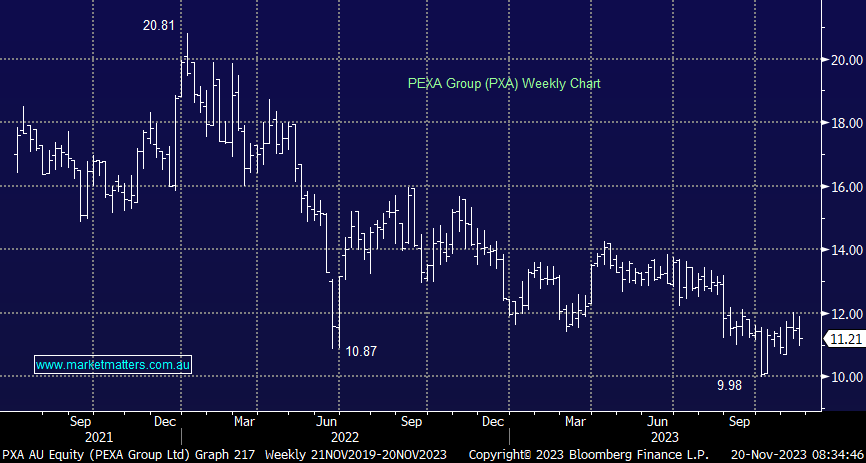

We are adding to property technology company PEXA (PXA). We see the potential for a regulatory tailwind to support the business while at or near a low in property transaction volumes.

We are adding to Sandfire Resources (SFR) given our medium term bullish view on copper while SFR has improved operationally over recent quarters.