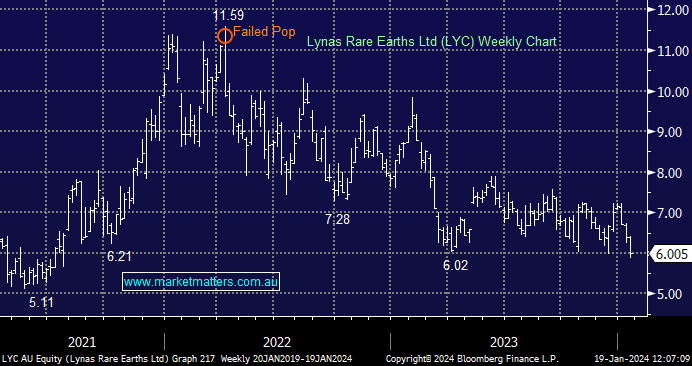

Does MM prefer Lynas or Iluka?

Happy New Year Market Matters Congratulations on your strong 2023 portfolio performance and keep up the great work! Both Lynas and Iluka are trading at very low price points - do they represent good value or are they too risky at this point in time. Does MM favour one over the other? Thanks and regards Rob