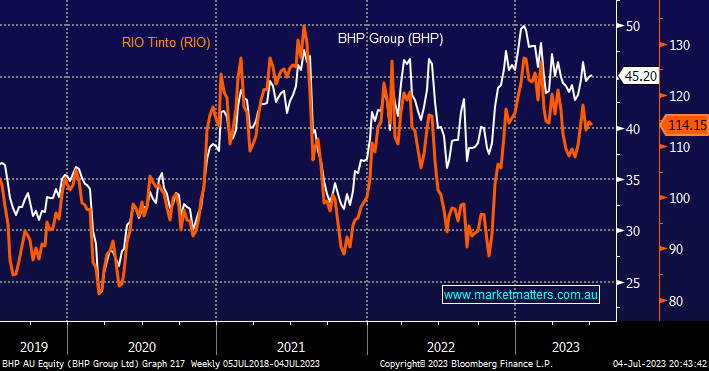

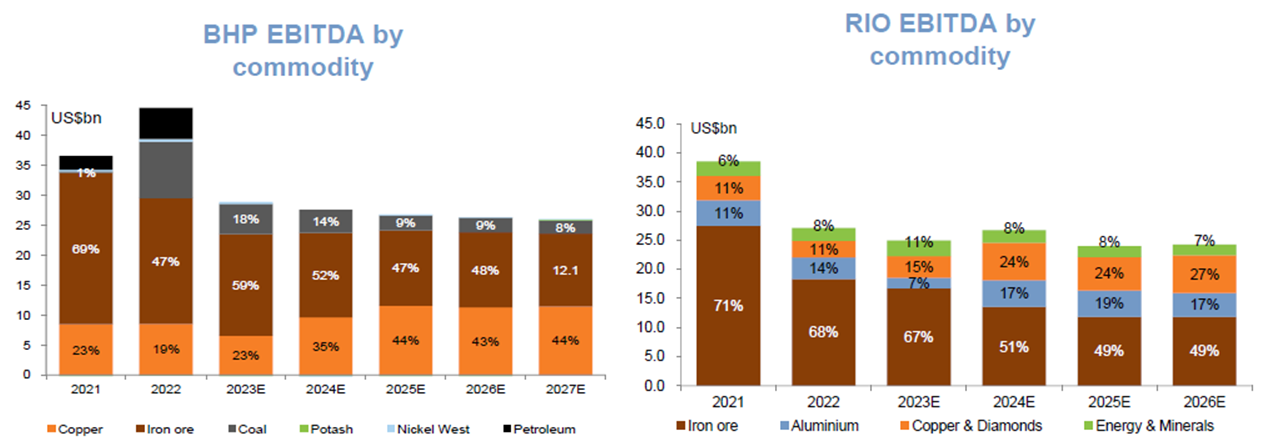

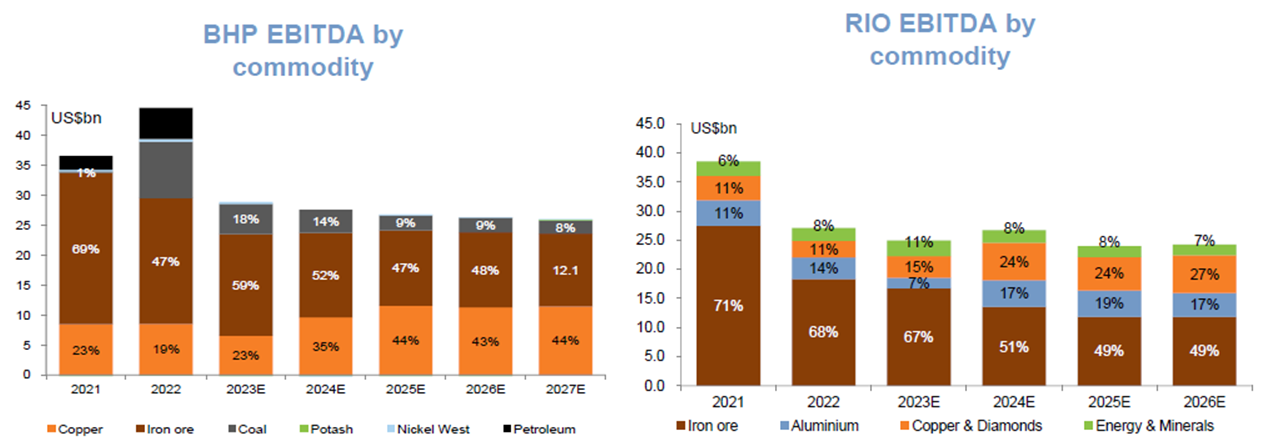

Throughout 2023 MM has discussed our penchant for both BHP Group (BHP) and South32 (S32) but we haven’t detailed why RIO has failed to make the cut, this morning we have clarified our reasoning behind this logic – ignoring a $162bn mining goliath should be explained! A picture can tell a thousand words and this morning we’ve used a couple of bar charts produced by Goldman Sachs to illustrate our reasoning:

As subscribers know MM is very bullish on copper’s outlook as the EV revolution gathers momentum while we are far more muted towards iron ore as China’s construction boom matures while production ratchets higher. When we look just 2-years ahead the earnings profile from both miners takes a very different format than today with the acquisition of OZ Minerals (OZL) by BHP having a meaningful impact:

- BHP Group (BHP) – BHP’s earnings in 2025 are estimated to almost double from copper to 44% whereas RIO’s will only be at 24% from the industrial metal and diamonds combined.

- Both companies are transitioning away from their dependency on iron ore but we prefer the current roadmap presented by BHP.

This is obviously a dynamic situation and if RIO succeeds in a takeover of a business we like, at an attractive price and a forward-looking commodity mix they could theoretically change the picture but we are conscious this won’t be easy as global miners as a whole look to become environmentally friendly businesses. Over recent years BHP has demonstrated its commitment to transitioning its business to a new green world by beefing up its Potash & Copper operations while selling off its Oil & Gas business to Woodside Energy (WDS), some major moves considering the scale of BHP.

- MM prefers BHP over RIO until further notice.

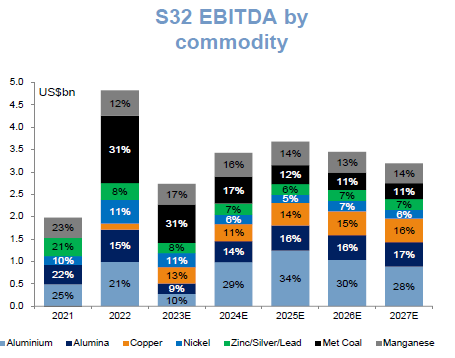

South32 (S32) appeals as it has zero exposure to iron ore and a good spread of exposure to “future-facing green commodities” – aluminium, alumina, nickel, copper and manganese. Also, their coking coal exposure is attractive in the medium term as we believe markets are positioned for an easier & cheaper transition to a clean world than will prove attainable.

S32 has remained on our Hitlist for months although we’ve remained patient as the miners corrected 25% from its January high – ongoing recession fears could cause ongoing weakness before we press the “Buy Button” assuming China doesn’t change the landscape with a huge stimulus package. When we look at its FY22 earnings it’s the coal 31% and 35% aluminium/alumina that has weighed on the company’s share price over the last 18 months, again we like the improved commodity mix estimated in 2025 hence we are looking to purchase S32 into current weakness.

- MM likes S32 into further weakness.