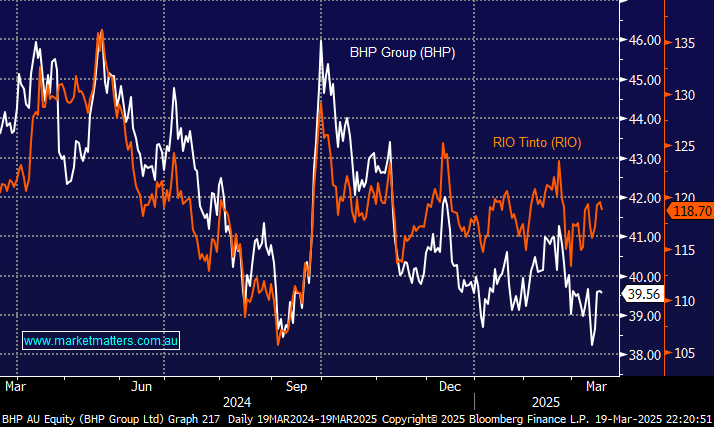

First off this morning, we’ve considered whether MM still prefers BHP Group (BHP) over RIO Tinto (RIO) as talk around the potential end to RIO’s dual listing gathers momentum – so far in 2025, RIO is up +1.8%, and BHP group (BHP) +0.2% while both have also paid healthy dividends. The commodities mix of both mining giants in 2024 was similar, although BHP has a greater Cu focus:

BHP: 50% iron ore, 36% copper and 14% coal

RIO: 51% iron ore, 24% aluminium, 16% copper and 9% minerals.

- We like both of these miners, but BHP’s more significant copper skew is particularly attractive to MM.

Moving on to the potential impact on RIO’s share price if they follow the same path as BHP and become one ASX giant. RIO’s current structure has been in place since the 1995 merger of Australia’s CRA and London’s RTZ Corporation. RIO management is saying that, theoretically, we would see an 11% decline in the value of Australian shares and a 4% increase in the value of London stock. Hence, chairman Dominic Barton is fighting the rebel shareholder resolution. What we have today:

- Rio’s structure is built on an agreement between an ASX-listed company and a separate London-listed company, which compels the two companies to share all assets and profits and treat both sets of shareholders equally.

- Tax breaks on dividends in Australia have ensured Rio’s Australian shares have traditionally traded at a premium to the stock listed in London – franking as we all know it.

An independent review feels a likely outcome with Australian shareholders set to vote on the resolution on May 1st. If we see an unravelling of the 30-year-old agreement, the largest beneficiaries are likely to be investors who own UK stock, although considering BHP’s result, the weakness to ASX-listed RIO shares feels overstated.

- We like RIO at this stage, but it feels too hard compared to BHP.