BHP’s portfolio of copper assets remains the jewel of the industry, and it still has substantial room to grow. The group’s 2025 financial results underscored this strength, with copper operations in Chile and South Australia delivering 48% of total earnings, while CEO Mike Henry highlighted ambitions to advance growth projects in Argentina and finally unlock the long-promised Resolution mine in Arizona. The second message was just as clear: BHP intends to hold its nerve on M&A, even as large-scale deals return to the mining sector after a long period of restraint.

Its main near-term focus is unlocking further growth at its giant Escondida project in Chile, but it is yet to formally press the button on investing to double the production of its South Australian copper assets over the next decade, which is centred around the expansion of its Olympic Dam mine. The Resolution mine in Arizona would be a world-class project, but even after decades, and with the new impetus of Donald Trump’s critical minerals push, it still hasn’t got the final regulatory approvals it requires. Hence, BHP has a runway of growth, but the bulk of it is fairly long-dated. Buying Anglo’s assets would have fixed that issue.

We believe the AAL uncertainty has left BHP trading on the cheap side in a fairly rich market: its trading inline with its 5-year valuation whereas RIO is ~13% above its average, this is one elastic band we don’t expect to stretch further, especially with RIO more dependent on iron ore.

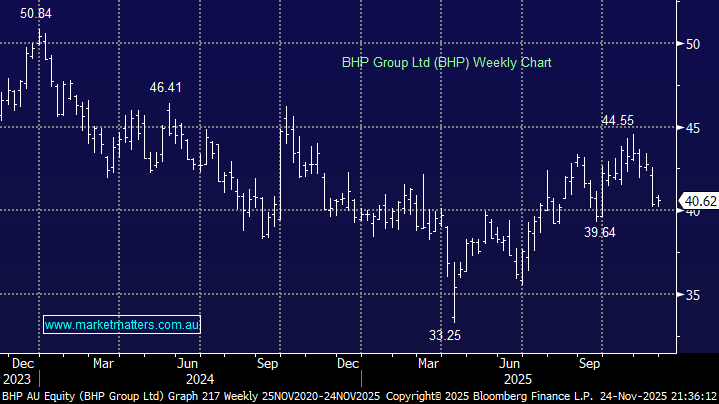

- We like BHP as a growth and yield play into 2026 but are conscious that commodity prices will largely determine its share price. We see good buying ~$40.