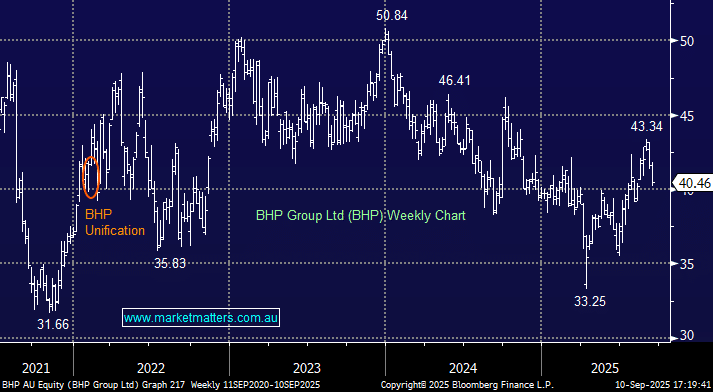

BHP has retreated 6.6% from its late August high, a deeper pullback than the index’s 3.6% retreat. However, the “Big Australian” has also paid a 60c fully franked dividend, reducing the short-term underperformance to just 1%. While we remain bullish towards copper and iron ore, we see no reason to reduce our exposure to the world’s biggest miner because of some market noise, albeit real.

- We are still targeting the $45-46 area for BHP as iron ore edges towards $US110/MT: MM holds BHP in its Active Growth Portfolio and Active Income Portfolios.