Portfolio construction is about holding a collection of positions/earnings streams at sensible weights to meet the specific goals of a particular strategy. In the case of the Market Matters Income strategy, that goal is to combine a collection of income producing equities, ETFs and listed Income Securities to satisfy investors looking for sustainable and consistent income, with significantly less volatility than the market.

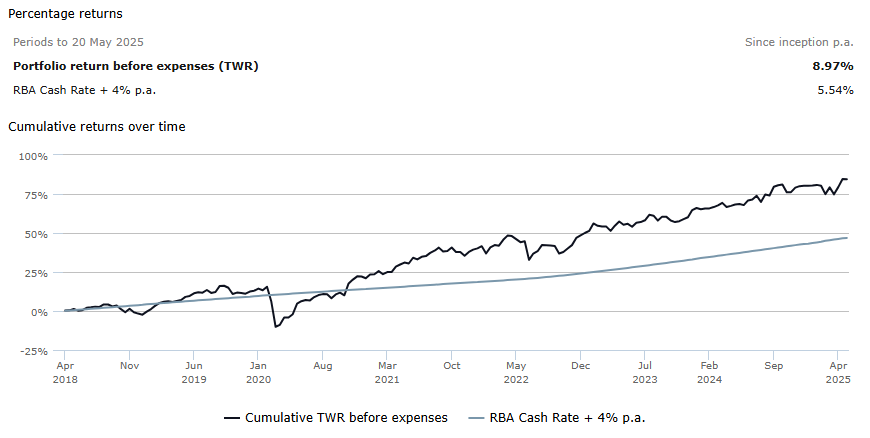

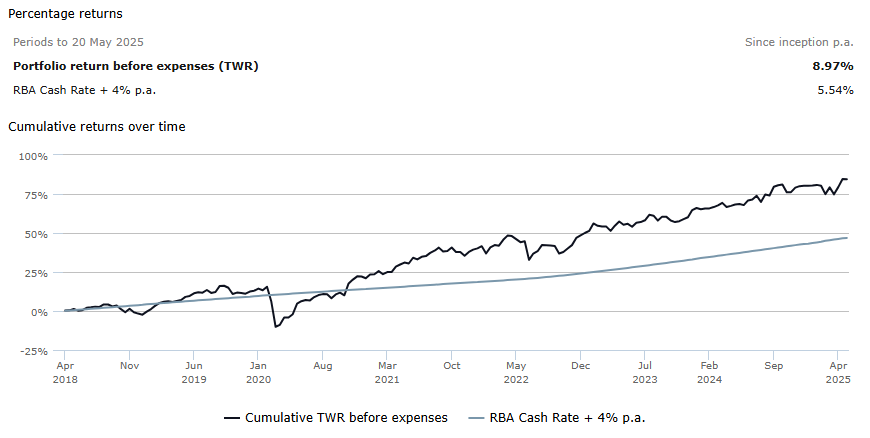

This goal has been achieved over time, and while the portfolio has booked a total return of ~9% a year, it’s the income and relative stability in the capital that have been key priorities for the investment team. In the recent tariff tantrum, the maximum portfolio drawdown was less than 5%.

In the past few weeks, we’ve had several discussions whether or not BHP is still suitable in this portfolio, or are we just holding it because it’s the 2nd largest stock on the market, and it feel safe? Should we be more focussed on companies with less leverage to volatile commodity cycles, stocks like Smart Group (SIQ) or Dicker Data (DDR) that reside on the Income Portfolio Hitlist, or increase our exposure to less volatile income securities, one of which we’ll discuss today.

Portfolio construction is just as important as security selection, specifically around how positions complement or contradict others. A level of contradiction is important for a portfolio shooting for lower volatility. This can often be gained through diversification, however given our high conviction approach of ~20 positions per portfolio, we focus on the correlation of positions. We have 8% in BHP, which is below index level, however this is not an index tracking portfolio (even though it has outperformed the ASX 200 over time). In addition, we hold 4% in Fortescue Metals (FMG) and 4% in New Hope Corp (NHC) creating a ~16% tilt towards commodities.

- While we’re bullish on commodities, and have been a for a while now, this is an early ‘warning’ that we believe an 8% position in BHP for our Income strategy is perhaps too high, and readers/investors should expect this to be addressed in time.