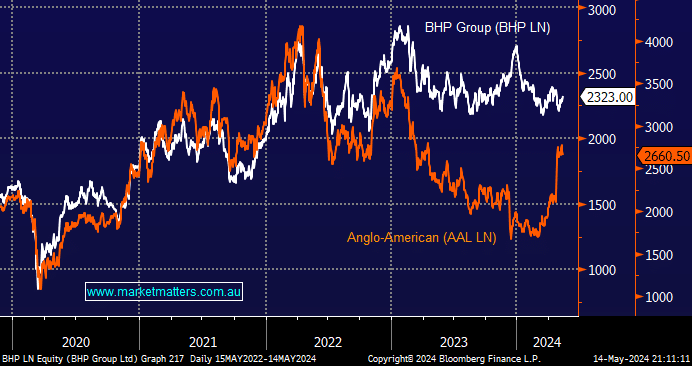

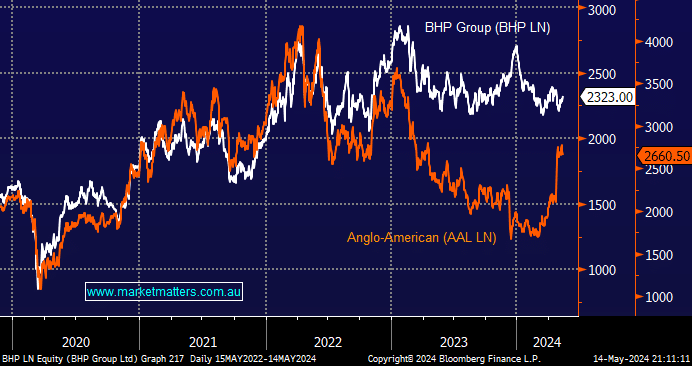

In 1921, Henrick Ibsen coined the adage “A picture tells a thousand words”, not Confucius as many believe. A quick glance at the relative performance of these two news-hogging stocks paints a clear picture as to why BHP may have thought it was a good idea to use its own stock to buy AAL; the moves effectively a switch. Obviously, there is far more to it, but the jewel for BHP is AAL’s prized copper assets, and it will be interesting to see if they walk after two attempts just after copper pops above $US5.00. Last night, we heard AAL’s restructuring plans to fend off BHP; they sound similar in essence to BHP’s plans, effectively supporting BHP’s strategy.

- Anglo American plans to exit diamond, platinum, and coal to turn itself into a global copper giant.

- As the news hit markets in London. AAL fell over 2%, well below BHP’s second bid, while BHP rallied over 3%.

- By the end of the session in London, AAL was down -3.2%, and BHP had finished up +2%; at this stage, Anglo shareholders would have been better off under BHP’s second bid.

BHP might contemplate letting AAL undergo all of the restructuring’s heavy lifting before revisiting for a third time. However, considering the lukewarm market reception to AAL’s plans, BHP may be tempted to lob in a slightly higher “best & final” bid and see if shareholder pressure forces the board to reconsider. At the end of the day, it’s a personality decision for shareholders: Whose the best operator to transform AAL and its copper assets, John Heasley & Co at AAL, or Mike Henry and the BHP management team?