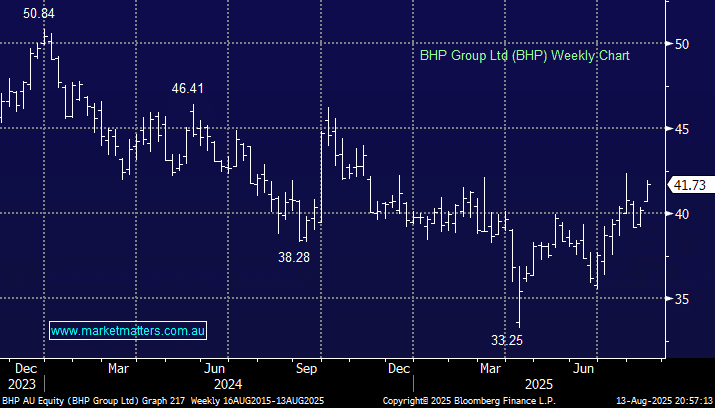

BHP has been relatively unloved for much of this year, but as iron ore holds above $100/MT, begrudging upgrades are likely to be lurking in the wings – it advanced +1.1% on Wednesday. On top of their robust iron ore division, copper now makes up ~35% of the “Big Australians” revenue so it’s not a one trick pony with the industrial metal, which MM is very bullish over the coming years, set to improve the miner’s revenue mix over time.

- We are initially looking for BHP to test $45, or ~8% higher, but we can see further upside: we hold BHP in our Active Growth Portfolio and Active Income Portfolios.