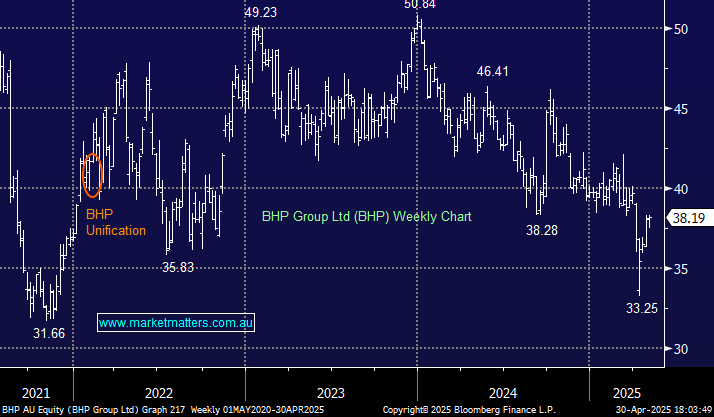

BHP is down less than 4% in 2025, but it also closed on its high yesterday, although in a less dramatic manner, with the miners treading water for most of Wednesday. The world’s largest miner is dependent on China’s economy, which translates to the price of important commodities, iron ore and copper; at this stage, the jury is out on this mix.

- We continue to believe earnings upgrades will occur if iron ore remains around $US100/MT. We hold BHP in our Active Income and Active Growth Portfolios.