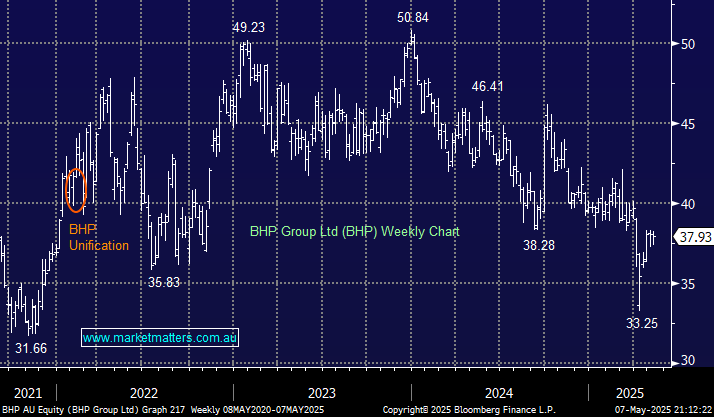

BHP is down around 4% in 2025, slightly underperforming the ASX200, which is up +0.2%. The world’s largest miner depends on China’s economy, with over 60% of its revenue coming from the world’s second-largest economy in FY24. On the commodities front, it was 50% Fe and 36% Cu, with the industrial metals BHP’s future focus, similar to Barrick; we like how the “Big Australian” commodities mix is evolving. We are optimistic towards China, hence with a forecasted fully franked yield of over 4% in the next 12 months, we are comfortable being patient as the market’s pessimism remains entrenched; we like the risk/reward around $38.

- We believe earnings upgrades will occur if iron ore remains around $US100/MT: We hold BHP in our Active Income and Active Growth Portfolios.