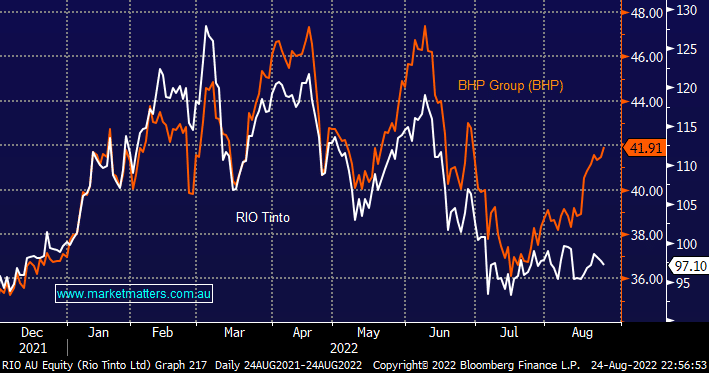

The last couple of months have seen a huge and uncharacteristic divergence between BHP and old rival RIO i.e. RIO has underperformed the index only bouncing +5.6% from its June low whereas BHP has advanced over +17%, more than 3x its rival. We like BHP’s corporate moves over the last 12-months where its spun off its oil assets into Woodside Energy (WDS) and bid for copper miner OZ Minerals (OZL) very clear steps to a more ESG future and although iron ore and coal still dominate its current earnings the company has clearly flagged its intention for the future.

- We believe BHP’s high ASX index weight since its reunification of listing structures has had a hand in this divergence.

- However, we see no reason to buy RIO over BHP until it takes more discernible steps to commence its evolution from its primarily iron ore business model.

- We are long BHP looking forward to its $US1.75 fully franked dividend in September but we can see ourselves reducing our large position slightly as the iron ore picture clouds due to huge economic headwinds building in China.