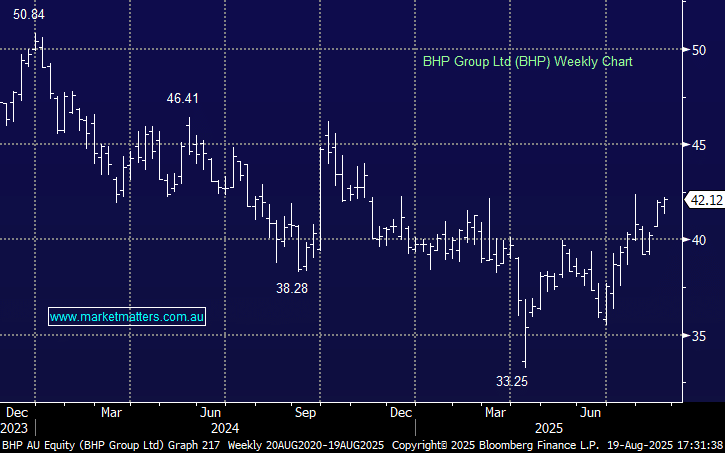

BHP +1.57%: Delivered FY25 results broadly in line with consensus, with dividends surprising to the upside despite softer earnings.

- Revenue of $US51.26 billion, -7.9% y/y, estimate $51.36 billion

- FY25 underlying earnings before interest tax depreciation amortization (ebitda) $US25.98 billion, -10% y/y, estimate $US26.22 billion

- Final dividend of US60cps taking total FY25 dividend to $US1.10, ahead of expectations (equates to ~A92c) for the half.

While earnings fell on lower total export volumes, a higher dividend payout, steady FY26 cost guidance, and projects like the Jansen Potash on track for mid 2027 will support growth, though demand from China and India to a lesser extent remains the key driver amid a mixed global macro backdrop.

- MM likes the growth and yield outlook for BHP, holding it in both the Active Growth and Active Income Portfolios