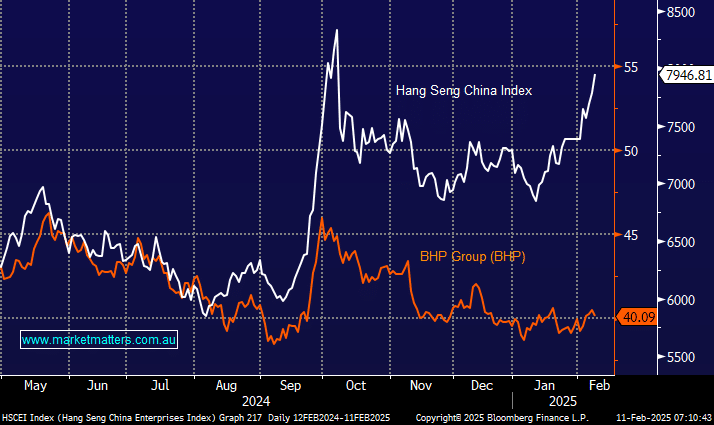

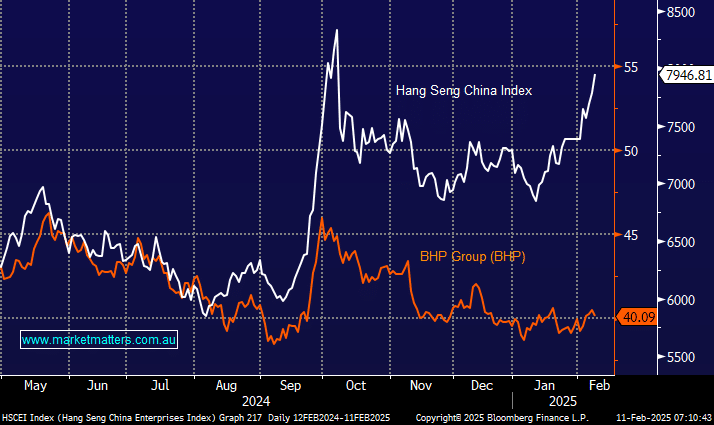

BHP, the “Big Australian,” has been a laggard on the ASX and compared to Chinese stocks. The main reason is the much-discussed outlook for iron ore, with significant production coming online later this year. BHP is due to report next week, so we can expect some volatility, but bar any surprises, we believe its share price will be driven by commodity prices and forecasts, with the latter being one area in which we can see begrudging upgrades this year.

- BHP’s share price has underperformed declining earnings estimates, giving room for upside surprises.

- We can see BHP trading back above $45 in 2025: MM is long BHP in its Active Growth Portfolio and Active Income Portfolio.