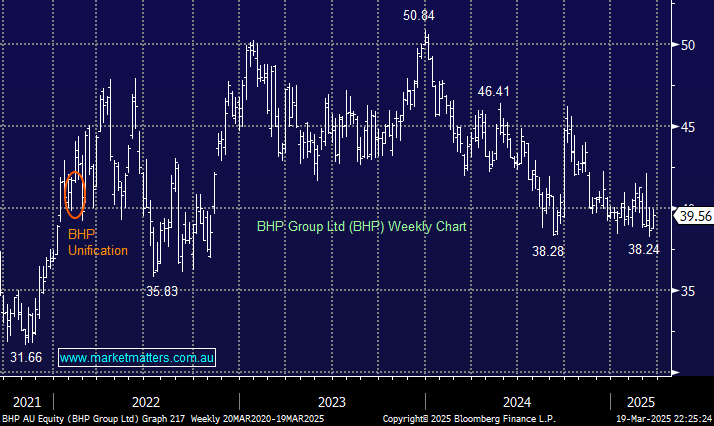

BHP Group unified its share structure in January 2022, simplifying its corporate structure by consolidating its dual-listed company on the Australian Securities Exchange (ASX). Shareholders of BHP Plc (UK-listed) received BHP Limited (ASX) shares at a 1:1 exchange ratio. The strategic benefits to BHP included more efficient capital management, more uncomplicated M&A activity, and lower administrative costs.

Initially, BHP’s London-listed shares dropped as UK investors sold their holdings due to index removals, while on the ASX, BHP’s weighting in the S&P/ASX 200 increased, attracting more Australian institutional investment. However, a glance at the BHP chart reveals that it had little impact on the stock in the broader context.

- We are looking for BHP to test the $45 in 2025/6 and own the stock in our Active Income and Active Growth Portfolios.

- At this stage, we prefer BHP over RIO due to its resource mix, including higher copper revenue plus the lack of uncertainty around dual listing.