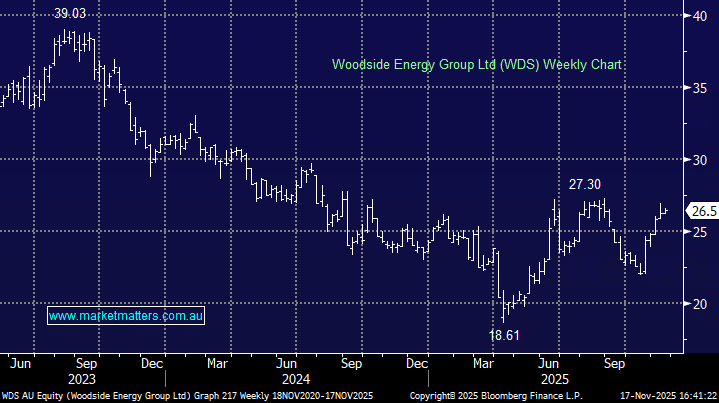

We discussed our bullish outlook towards WDS last week, with the view on point so far. It was encouraging to see the stock rally from the open on Monday to close up +0.9%, outperforming the broad market throughout the day. One session doesn’t make a summer, but increasing gas demand particularly in Asia, as data centres and AI requirements escalate, bodes well for this ASX energy giant.

- We can see further upside in WDS with our initial target around the $30 area, or ~13% higher.

We are holding a WDS position in “Shawn’s Trading Ideas”; we will raise the stop if/when WDS trades to new November highs.

- Long Woodside Energy (WDS) at $24.40, with stops at $25.40, a profit stop.