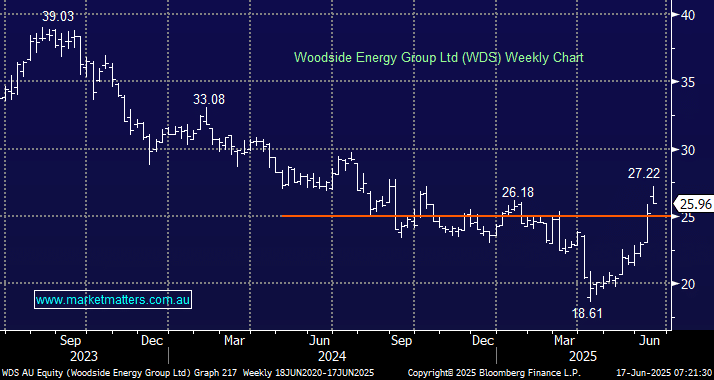

WDS advanced another +3% on Monday although Australia’s largest energy play closed almost 5% below its intra-day and 2025 high – like the local gold sector, it called the overnight moves exceptionally well. The coming weeks will see the oil price and news around STO dictate the direction for WDS. If the STO takeover gets the green light, it’s one less energy option for investors on the ASX, which should be supportive of the WDS share price, in a similar fashion to how Sandfire (SFR) following BHP’s takeover of OZ Minerals (OZL) in the copper space. At this stage, we are going off the assumption that WDS has bottomed in 2025, with the stock looking interesting 3-4% below Monday’s close, where it spent most of the 2H of 2024.

- We like the risk/reward towards WDS around $25, initially targeting a test of the $28-30 area after our initial target has been exceeded.

Shawn’s Trade idea timed its entry into WDS nicely, and will likely raise the stop in the coming days, in case the last few days become a classic “sell on news” event.