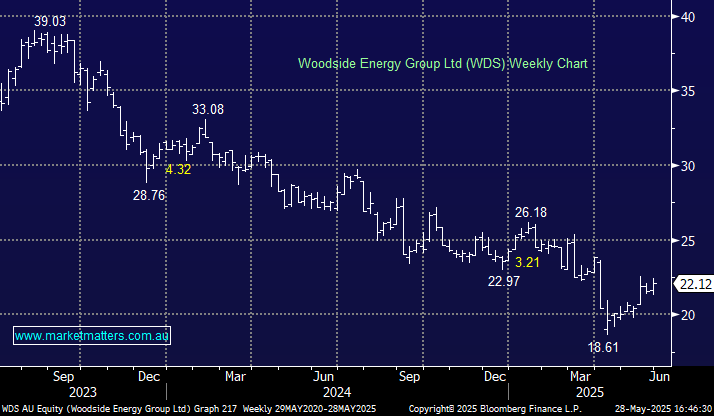

WDS advanced +3.2% on Tuesday, welcoming the news that the Albanese government has given the company the approval to extend the life of its North West Shelf gas development until 2070. The move marks the end of almost seven years of state and federal government approval processes, an unfortunate illustration of the red tape facing most Australian companies. A decision like this would probably take seven days to get a yes or no in China! The extension means that the plant, which began operating in the late 1980s, will not have to close in 2030. It also paves the way for the development of the Browse gas fields, a project so vast that it has become a lightning rod for environmental activism.

Support for the use of gas in the transition away from fossil fuels, including coal, which produces higher emissions, should provide a tailwind for WDS. With power bills rising, there is increasing pressure on politicians to free up supply to meet demand. We believe the likes of WDS have seen the short-term nadir in terms of political hurdles. We have adopted a more positive stance towards WDS, but with Trump determined to get fuel prices lower, we wouldn’t be chasing strength.

- We like the risk/reward towards WDS below $22, initially targeting a test of the $25-26 area in the coming year.