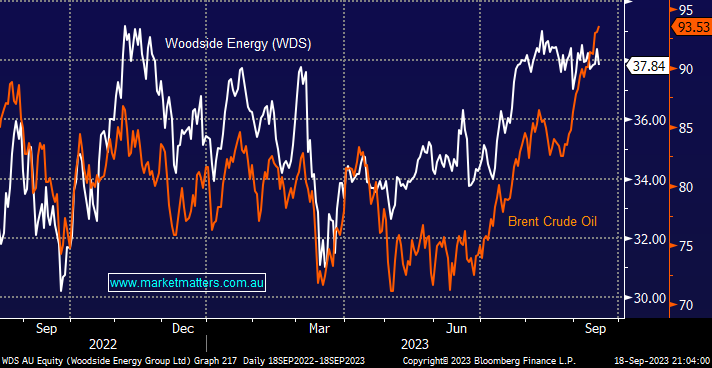

Even after taking into account last month’s $1.24 fully franked dividend, WDS has started to look tired around the $38 area even as crude oil continues to post new 12-month highs, over 10% higher than when WDS first tested $38 this year. We remain bullish on the Energy Sector, but it is starting to feel like a crowded trade as crude pushes ever higher. On Monday, WDS slipped -1.5% with crude at a fresh 2023 high, but with the stock estimated to yield more than 5% over the next 12 months, we are not considering selling weakness.

- We still intend to sell/trim our WDS exposure into strength, ideally around $40.