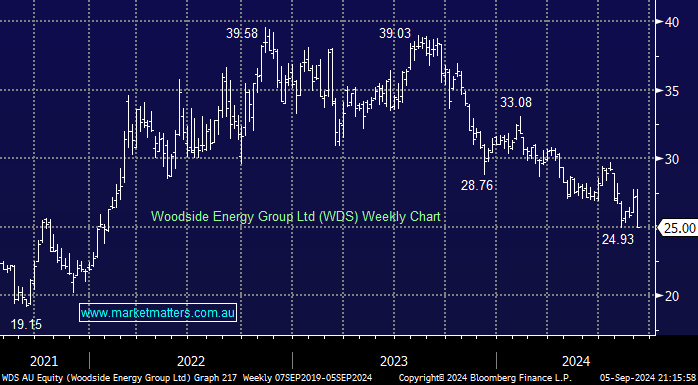

Woodside Energy (WDS) reported well relative to expectations in August, which saw a corresponding beat to the interim dividend, with its 80% payout retained. We expect WDS to continue paying out 80% of profit, delivering a 2024 div yield of 7.5%, falling to 4.5% by 2026. Moving forward, a weaker oil price could see the 80% figure wound back. WDS is currently factoring in an oil price ~10% lower, which does deliver a cushion, but if we see ongoing weakness in oil below $US70/bbl., WDS is likely to fall towards its 2022 lows.

- We remain neutral toward WDS, given they have some big CAPEX bills on the horizon set to weigh on free cash flow (FCF). We’re 50-50 on where the next $5/20% move will be.