The ASX eased into the weekend as investors stayed cautious ahead of next week’s high-stakes meeting between US President Donald Trump and China’s Xi Jinping, while news of the abrupt termination of US-Canada trade talks also added some complexity to the mix.

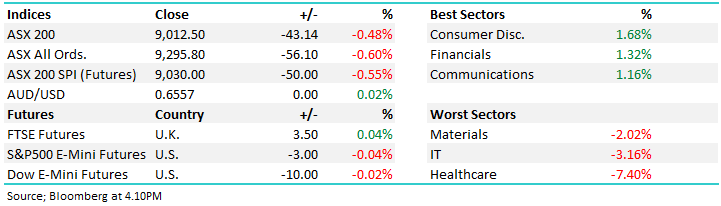

- The ASX200 dipped -13pts/-0.15% to close at 9019

- IT (+1.32%) Materials (+0.41%) and Property (+0.36%) led the line – three sectors we are heavily exposed to in the Growth Portfolio.

- Healthcare (-1.23%), Staples (-0.75%) and Financials (-0.54%) the weakest links.

- Energy remained firm following US sanctions on Russian oil giants Rosneft and Lukoil, which briefly sent crude to US$65/bbl.

- Woodside (WDS) +1%, Beach (BPT) +0.4%, Ampol (ALD) +0.4% rose, though Santos (STO) -1.2% eased.

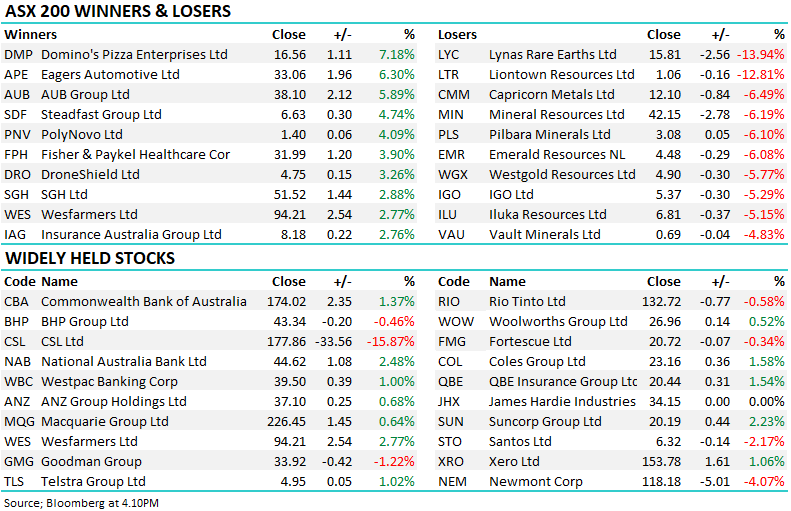

- Critical minerals ended the week on a high — Mineral Resources (MIN) +6.5%, IGO +8%, Pilbara (PLS) +9% after a strong quarterly revenue lift.

- Among the majors, Rio Tinto (RIO) +1.5%, BHP (BHP) -0.5%, though Fortescue (FMG) –1.5% pulled back after a strong week.

- Gold struggled to hold early gains — Newmont (NEM) -4.4%, Northern Star (NST) -1.7%, and Evolution (EVN) -1.1%

- Spot gold has now fallen -3% this week, its biggest weekly drop since May, despite analysts remaining broadly bullish on the medium-term outlook.

- Banks underperformed — ANZ -1%, CBA -0.7%, NAB -0.3%, with Westpac (WBC) flat.

- Property Group GPT +1% after acquiring a stake in Sydney’s Grosvenor Place from Commonwealth Super Corp for $860 m.

- Mount Gibson Iron (MGX) -27% collapsed after announcing the closure of its 80-year-old Koolan Island mine post-rockfall.

- Nick Scali (NCK) +0.6% rose as long-time chair John Ingram announced his retirement.

- Whitehaven Coal (WHC) -0.4% reported $200 m cash burn over the September quarter as prices remain subdued.

- Coronado Global (CRN) +6% rebounded after clarifying a minor roof fall in its US Buchanan mine had limited operational impact.

- WiseTech (WTC) +3% finally bounced, offering good risk/reward for a recovery from currently depressed levels.

- Regis Healthcare (REG) +9% rallied after the Australian aged care provider announced it will buy two homes in coastal Victoria for $45 million

- Asian markets were firm, with Hong Kong +0.7%, China up +0.6%, while Japan was +1.4% higher.

- Gold traded lower during the session, off $US12 to $4113/oz around the close.

- Iron Ore in Singapore traded down 0.8%, now trading $103.80/mt at our close.

- US futures are up +0.20%.

- HCA Healthcare (HCA US), which we hold in the International Equities Portfolio, reports tonight