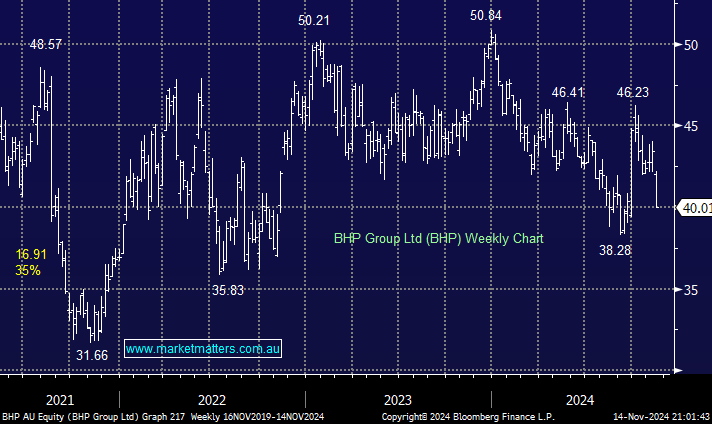

BHP is a world-quality diversified miner that is relatively low beta in the sector. This fits with a more cautious approach as questions are raised around China into 2025. A 5% ff yield helps when holding BHP, but having already topped up our position from 9.5% to 8% around $40, this position feels okay at this stage.

- We are comfortable with our BHP exposure at this stage – MM is long BHP in its Active Growth and Active Income portfolios.