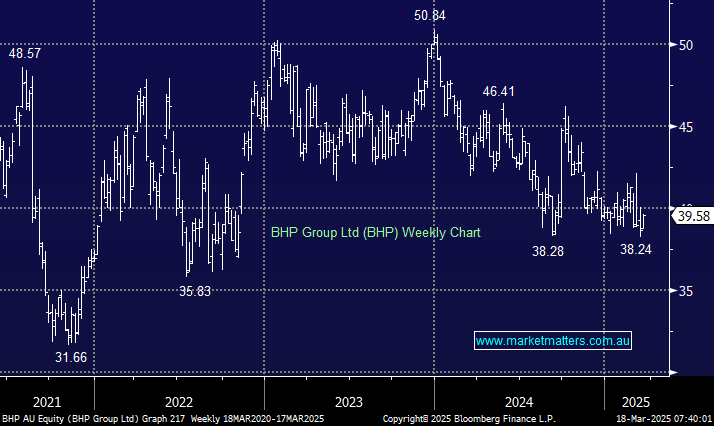

BHP has rotated around the $40 area for over six months while yielding ~5% fully franked; their most recent 50c dividend will hit investors’ accounts later this month. The “Big Australian” is a relatively conservative play on improved Chinese growth and commodity prices, both of which we like moving forward. We don’t expect fireworks from the BHP share price but we do believe it will be higher by Christmas.

- We can see BHP testing $42 this FY, but the longer Fe can hold above $US100/Mt, the greater the chance of a squeeze up toward $45: MM is long BHP in the Active Growth Portfolio and Active Income Portfolios.