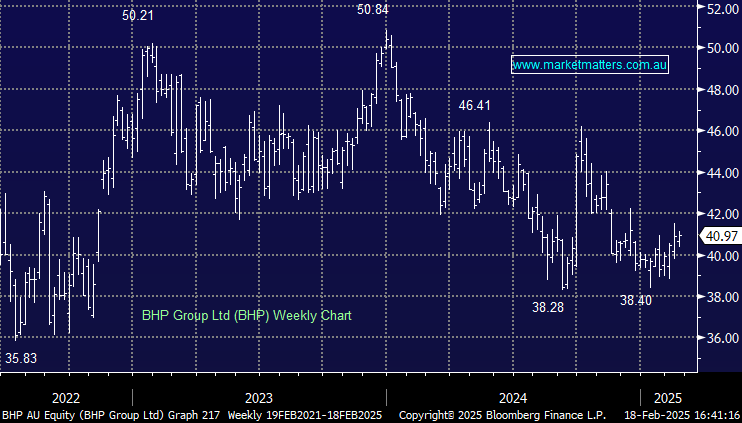

BHP +0.42%: Delivered an in-line result, and as we often see in the resources space, limited surprises given the company released their December quarter update less than a month ago which led to a muted response from the market today.

- Underlying NPAT of US$5,032mn, -23% yoy

- Underlying EPS of 100.2cps vs. 95cps consensus

- Interim dividend of 50cps in-line with consensus

- Capex guided to US$10bn in FY25 and US$11bn in FY26

The key influence on the year-on-year slump in earnings were commodity prices – mainly iron ore. BHP reiterates its view that iron ore cost support is in the range of US$80-100/t and it expects prices to be in that range in the short to medium term given demand is flat and supply is increasing – these forecasts being in line with analysts expectations. Coking coal is also seeing a modest surplus in the short-term, though they see prices supported in the medium-term.

Beyond this result, Chinese stimulus and M&A activity from BHP are the likely catalysts for the stock to move in the short to medium term. Irrespective, if the iron ore price can stay at current levels ~$105/MT for longer, at the upper-end of forecasts, we see room for upgrades.