Woodside is already a top 10 global LNG producer and is expanding volumes through ongoing development including; Scarborough LNG (first gas ~2026/27), Trion FPSO (Mexico, early 2030s) + Pluto Expansion & North West Shelf life-extension & tiebacks. LNG demand is forecast to grow 30–50% by 2040, particularly in Asia as data centres and AI workloads need firm, 24/7, low-carbon-per-MWh power. Gas fills the reliability gap as coal retires, and renewables hit intermittency limitations. WDS LNG is exported into the Asian grid – Japan, South Korea, China, Singapore – all of which are aggressively expanding data-centre footprints. They rely heavily on imported LNG to meet flexible baseload requirements.

- Several U.S. utilities have already reopened discussions for new gas plants to meet AI load. Asia will be more dependent on LNG due to lack of pipeline gas supply and Woodside is one of the few global producers with expansion options large enough to help fill the gap.

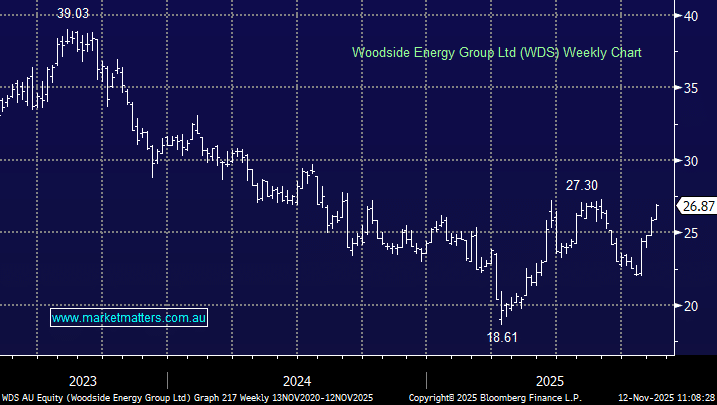

Increasing demand for gas should underpin prices, although oil also has a big bearing on how Woodside trades. We are less certain about the outlook for oil than gas and this has kept us on the sidelines for the past few years, though there are some signs that oil prices are stabilising above $US60/barrel, and with gas demand poised to increase in the years ahead, this could underpin a resurgence for Woodside – it’s certainly been a very underwhelming last few years for shareholders.

- We like the risk/rewards WDS below $27 aided by an estimated ~4% fully franked yield which is forecast to grow over time.