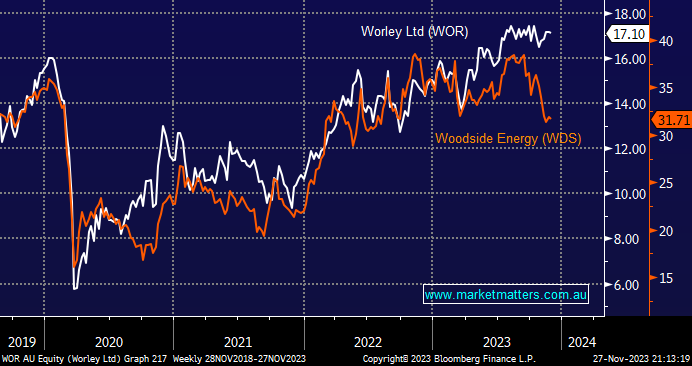

The correlation between WOR and WDS has been very close post-COVID, apart from over recent months where WOR has proved a big winner; year-to-date, WOR is up +14.1% while WDS has fallen -10.4%. We are in no hurry to consider switching our WOR holding into WDS, but another 10% differential might create some temptation. We believe WOR offers significant earnings leverage to a cycle of global energy investment and decarbonisation projects, making it a better play than WDS over the coming greener years, hence our current position.

- We can see the elastic band snapping back if/when we see WOR around $18 and WDS under $30; we are long WOR in our Active Growth Portfolio.