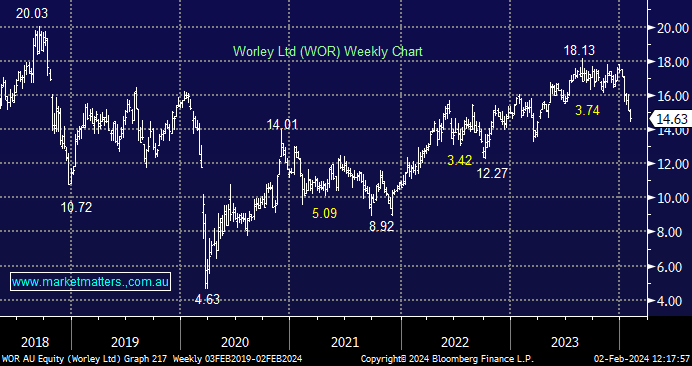

What are MM’s current thoughts on WOR & IGO?

Hi MM, I have the following queries: 1) Worley: As of a quite recent update, MM remains long and bullish WOR. I assume this is still the case? Given the recent fall in share price, is there an approximate price which MM views as particularly cheap? Is MM considering topping up its holding, whether now or following any further fall in price? 2) IGO: given the latest developments with IGO, including in relation to the Cosmos nickel project (potentially a positive in some respects?) and now, in particular, the Tropicana gold mine royalty claim, does MM consider IGO to be an "avoid" at present or still worth considering at current levels? From memory, MM said it already has sufficient lithium exposure but would otherwise consider IGO at current levels or has that now changed? Thanks and regards, Darren