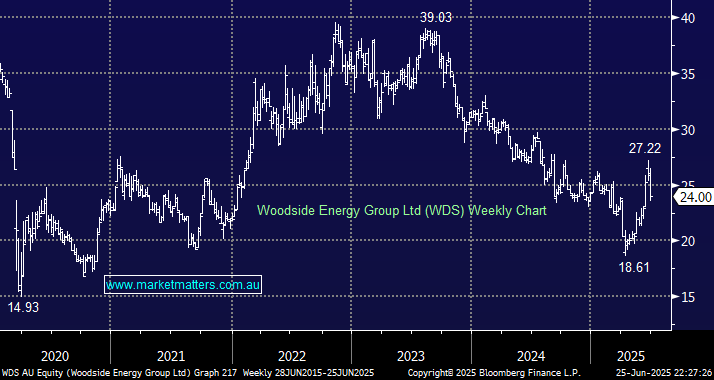

WDS closed on Wednesday more than 38% below its 2023 high, while crude oil is trading 31% below its 2023 high, it’s not complicated; the positive correlation is strong. With President Trump pursuing his “Drill Baby Drill” mantra and OPEC+ currently happy to push prices lower, it’s a tough argument to make that crude oil will rally over the coming year, e.g. oil popped ~40% when Russia invaded Ukraine, yet when the Israel-Iran conflict broke out it only managed to rally ~20% at its best and within a week all of the gains have gone. WDS is still trading 4-5% above its pre-conflict level, yet oil prices have surrendered all their gains, making the risk-reward unattractive at current levels, in our opinion.

- We see no reason to believe WDS can outperform crude oil, which itself feels like a coin toss.