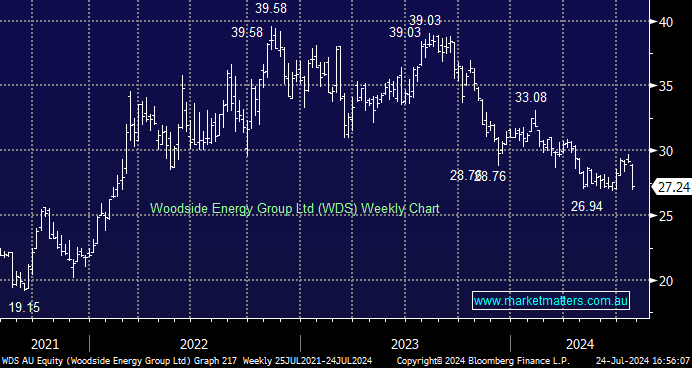

Several subscribers have wondered if/when we would add WDS to this portfolio as it continues to spiral lower; it’s down -11.4% year-to-date and almost 30% from its 2023 high. However, as we saw last week, the Energy Sector remains under pressure, with our PDN and WHC positions firmly ensconced in the “naughty corner”. As we alluded to earlier, performance elastic bands have been stretching further than most investors expected over the last year and fading such moves has often been costly. In the case of energy, Trump shouting “Drill baby drill” from the rooftops can be taken in more than one way; it certainly suggests increased supply out of the US with lower emission hurdles than our domestic companies may encounter.

- Hence, for MM to consider WDS into the current weakness we need to see some more encouraging signs on the corporate front.

WDS has announced the acquisition of troubled LNG developer Tellurian for $US900mn as it increases its exposure to LNG. WDS fell over 2% on the news, its largest one-day drop since May, while Tellurian (TELL US) shares soared 65% in the US. They also announced sales revenue of $3.03bn, down 1.7% year on year. WDS remains very well supported by the broker community with 7 Buys & 8 Holds, almost the opposite to CBA, which has rallied in 2024 compared to WDS, which has fallen; hence, MM doesn’t follow broker opinions without question like lemmings to the slaughter. We believe it’s hard to argue with Woodside, which is looking to deploy capital to grow its LNG business in arguably the lowest-cost free-market region to build and allocate additional capital overseas, especially considering climate activist pressure in Australia and the inability to progress local growth options.

- WDS has made a $US900mn offer for Tellurian (TELL UD) to own and operate the Driftwood LNG project (27.6mtpa).

- Driftwood extends WDS’ capex cycle, which will lengthen the time until capital returns – with initial guides after 2030.

It makes strategic sense to use balance sheet strength to buy a distressed player in its core business (LNG) in the lowest-cost region. However, investors aren’t convinced that WDS can execute its plans and they’ve initially adopted an “if in doubt, stay out” approach.

- We can see WDS holding the $25-26 area, but we’ve moved it to the “too hard” basket and removed it from our Hitlist.