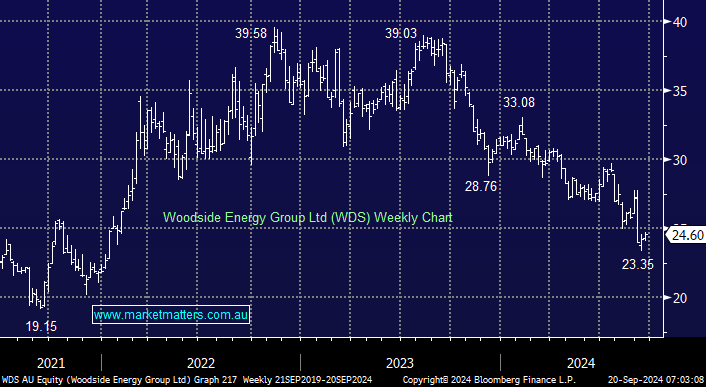

WDS is down over 20% year-to-date as it cuts through support levels like a knife through butter. Over the last year, “when to buy” this $46bn ASX oil & gas giant has been a common question from subscribers, but for all intents and purposes, it comes down to a bet on commodity prices after a recent solid report that contained no hidden surprises. Interestingly, US institutional holdings in Woodside have fallen from 23% of WDS’ register in Jan’23 to 17% in Sept’24; the likelihood is that most of this selling is finished, which should help WDS’s relative performance.

It’s important that subscribers understand we don’t regard WDS as a long-term dividend cash cow given rising capex over coming years, it’s more a commodities play. We can see WDS bouncing back towards the $27-8 area, but it’s unlikely to be on the MM Hitlist in 2024.

- We expect WDS to continue paying out 80% of profits, delivering a 2024 div yield of 7.8%, falling toward 4.5% by 2026 with large CAPEX bills on the horizon.