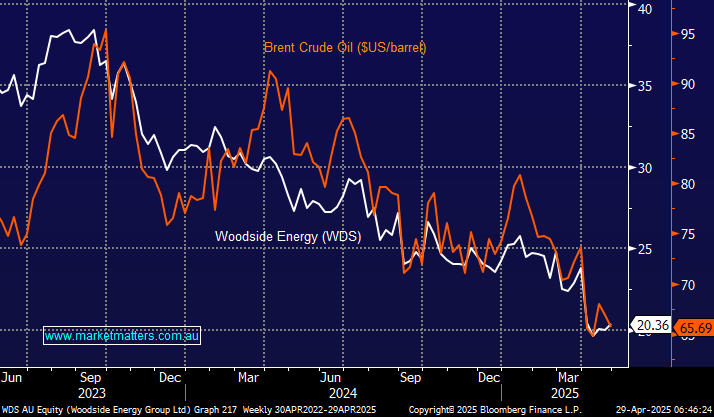

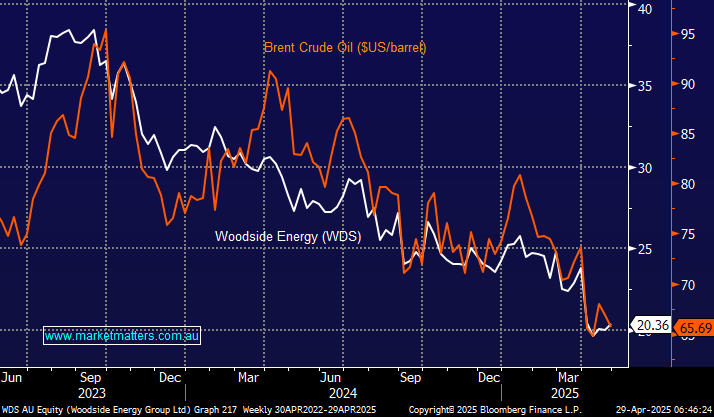

Strong global growth historically means high oil prices as demand outstrips supply, but with China struggling and tariffs weighing on consumer sentiment, things could easily get worse globally before they improve. Plus, OPEC is pressuring energy prices as they lift demand into an already weak market, and of course, President Trump is committed to getting fuel prices down in the US. The direct correlation between WDS and the oil price is evident, remaining in an established downtrend.

- We see no reason to try to pick when/where oil will bottom; there are easier ways to invest at this stage of the cycle.

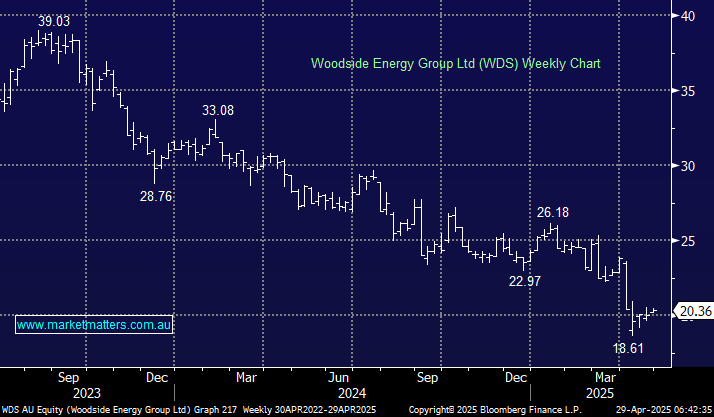

WDS has struggled over recent years, becoming a painful “yield trap” for many investors who have focused on its attractive $1.29 fully franked yield paid in 2024 – as we said earlier in the year management has their work cut out for them cutting costs to maintain earnings/dividends (payout ratio of 80%) amidst lower oil prices. To us, it’s simply not cheap enough considering the economic clouds forming over the global economy – it might not rain, but we don’t want to pay up for WDS with oil struggling in the $US65 area.

- We can see WDS making fresh 2025 lows in the coming months.