- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

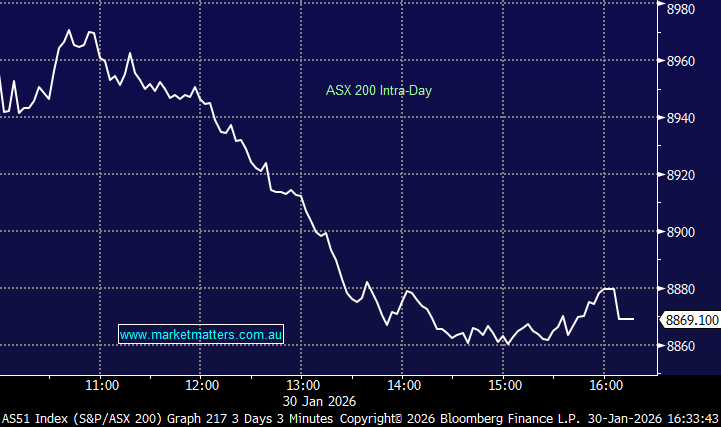

The ASX reversed earlier gains in the final session of the month, dragged lower by an accelerating sell-off in gold and other resource stocks as hot money headed for the exits. The rally in this part of the market has been impressive, however when stocks and commodities start to go parabolic, aggressive, short, sharp pullbacks become more likely, and we’ve certainly seen that play out today. Using BHP as the proxy for the sector, the stock hit a new all-time high above $52 early on, before reversing to close lower. Golds were hit harder with Newmont (NEM) trading at $190 yesterday before closing ~$173 today.

While the broader market sold off, there were pockets of strength – banks did well, other defensives were higher, with nearly 40% of the ASX200 still making gains.

Recent buying in Resources has coincided with a big sell-off in tech stocks, and while that sector still finished lower today, there are signs that a rotation out of hot resources into the unloved parts of the market could be afoot – property another sector that is now looking very interesting ahead of the RBA rate decision next week (70% probability of a hike already priced in).

- The ASX200 fell -58pts/-0.65% to close at 8869.

- Healthcare (+1.05%), Staples (+0.73%) and Financials (+0.48%) led the line.

- Materials (-3.36%), IT (-1.89%) and Consumer Discretionary (-0.19%) weighed.

- Gold equities sold off hard as spot gold fell ~US$170/oz during the session, trading ~$US5200/oz having been trading just below $US5600/oz overnight.

- Newmont (NEM) -8.1%, Genesis Minerals (GMD) -9.9%, Regis Resources (RRL) -5.4%, Evolution Mining (EVN) -6.4% and Northern Star (NST)-1.9 all ended lower

- The broader resource stocks also came under pressure; BHP Group (BHP) -1.8%, Fortescue (FMG) -2.7%, Rio Tinto (RIO) -3.5%

- Copper miners reversed early gains – Sandfire (SFR) -6.9% by the close

- Energy fell, with the recently hot Uranium stocks trading down; Paladin (PDN) –2.1%, NexGen (NXG) -4.3%

- Whitehaven (WHC) -6.7% came under pressure from multiple broker downgrades despite yesterday’s strong quarterly – most blaming valuation.

- Lithium stocks also saw big moves; Pilbara (PLS) -6.5% despite a solid December quarterly update, Mineral Resources (MIN) -6.3% despite a big upgrade from MQG to buy & $70pt, and Liontown (LTR) -9.5%

- As money came out of resources, other sectors benefitted; Healthcare rallied following a better than expected update from Remsed (RMD) +3.1% overnight, CSL +1.1% also saw some love.

- Banks also a beneficiary – ANZ Group (ANZ) +0.7%, Com Bank (CBA) +0.5%, National (NAB) +0.7% and Westpac (WBC) +0.8%

- It was still a solid month for the ASX despite today’s sell-off. The main board finishing January up +1.78% while the Small Caps added +2.74%

- That said, it remained a very polarising market, with Energy up +10.6% and Materials +9.5% versus Tech down –9.4%.

- Nine Entertainment (NEC) +5% rallied after announcing the $850m acquisition of QMS Media, alongside the divestment of its radio arm to the Laundy family and a shift to an affiliate model for regional TV.

- Star Entertainment (SGR) -15.6%, reversing early gains after reporting December-quarter EBITDA of $6m. While the group flagged $130m in available cash, management warned uncertainty remains elevated.

- Origin Energy (ORG) flat, reporting flat revenue of $2.1bn, with stronger LNG offsetting weaker domestic energy sales. FY26 LNG production guidance was modestly tightened.

- The AUD was trading around 70c at the close

- Gold was down ~$170/oz, trading at US$5200/oz around our close

- Copper fell -2.4% during the day having been up over 5% overnight.

- Iron ore traded down –0.5% to around US$103.60/t

- Asian markets were mixed, with China off -0.5%, Hong Kong down -1.7% while Japan was up +0.50%.

- US futures are trading down around 0.4%