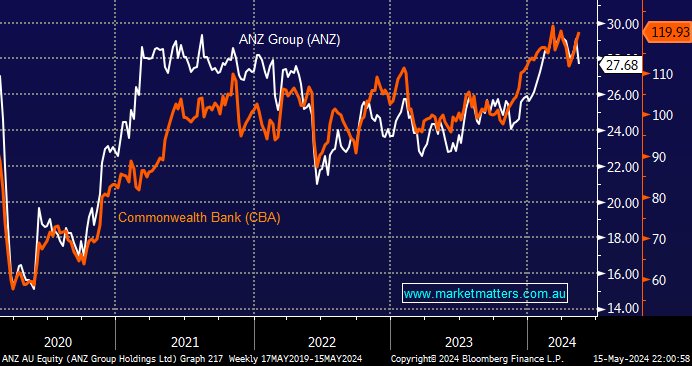

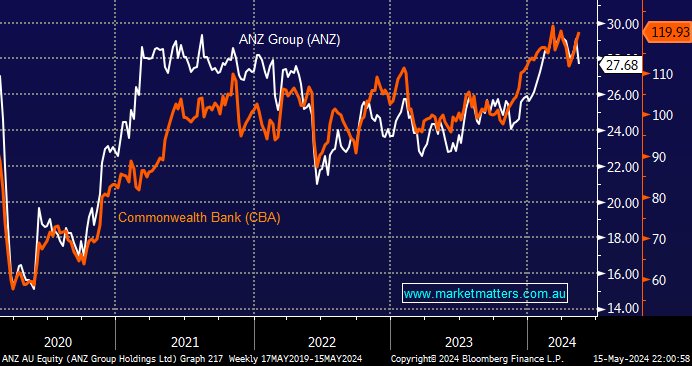

ANZ’s report this month was a slight miss to expectations primarily due to costs coming in ~1% above expectations. The important Net Interest Margin (NIM) fell 9bps half on half, but it was largely in line with forecasts. However, on the positive side, Tier 1 capital was well above expectations, driving a strong dividend (83cps vs 81cps expected) as well as a sizable $2b buyback. As we said at the time, the small miss for ANZ was offset by larger capital returns in dividends and buybacks – WBC and NAB both delivered slightly better results this month.

With ANZ trading ex-dividend 83c part franked (65%) this week and facing the prospect of integrating Suncorp’s banking arm into the fold, we are contemplating a switch to CBA, which will report and pay its dividend in August. We’ve been fans of Australia’s premier bank for years and we believe they are better placed to take advantage of the AI revolution that will drive efficiencies in banking.

- We are considering switching from ANZ to CBA as the – MM is long ANZ in our Active Growth Portfolio and CBA in our Active Income Portfolio.